Research Insights, July 11, 2023

House View H2 2023

Midway through 2023, the job market is cooling off and inflation is showing signs of moderating, but tighter lending conditions and wider macroeconomic disconnect still point to a mild recession. Our latest House View outlines how these conditions stand to impact commercial real estate investment, and where we’re pinpointing opportunity amidst the disruption.

---

U.S. Real Estate Investment Outlook

Macroeconomic Context

- Tighter lending conditions have made a recession before year end more likely.

- Consumers still strong, but uncertainty is weighing on spending, job, and business prospects.

- Credit market remains stressed with tighter lending impacting commercial real estate loan maturities.

Real Estate Impacts

- Transaction market awaiting greater economic and financial market clarity; deal flow likely to resume when rates stabilize and lending conditions improve.

- Necessity-oriented retail capturing greater share of consumer dollars by virtue of higher prices, tends to do better than discretionary segment during recessions.

- Office remains challenged with higher vacancy, lower demand, and upcoming loan maturities.

- Industrial and residential demand normalizing but declining starts and permits should support rent growth in 2024-2026.

Labor

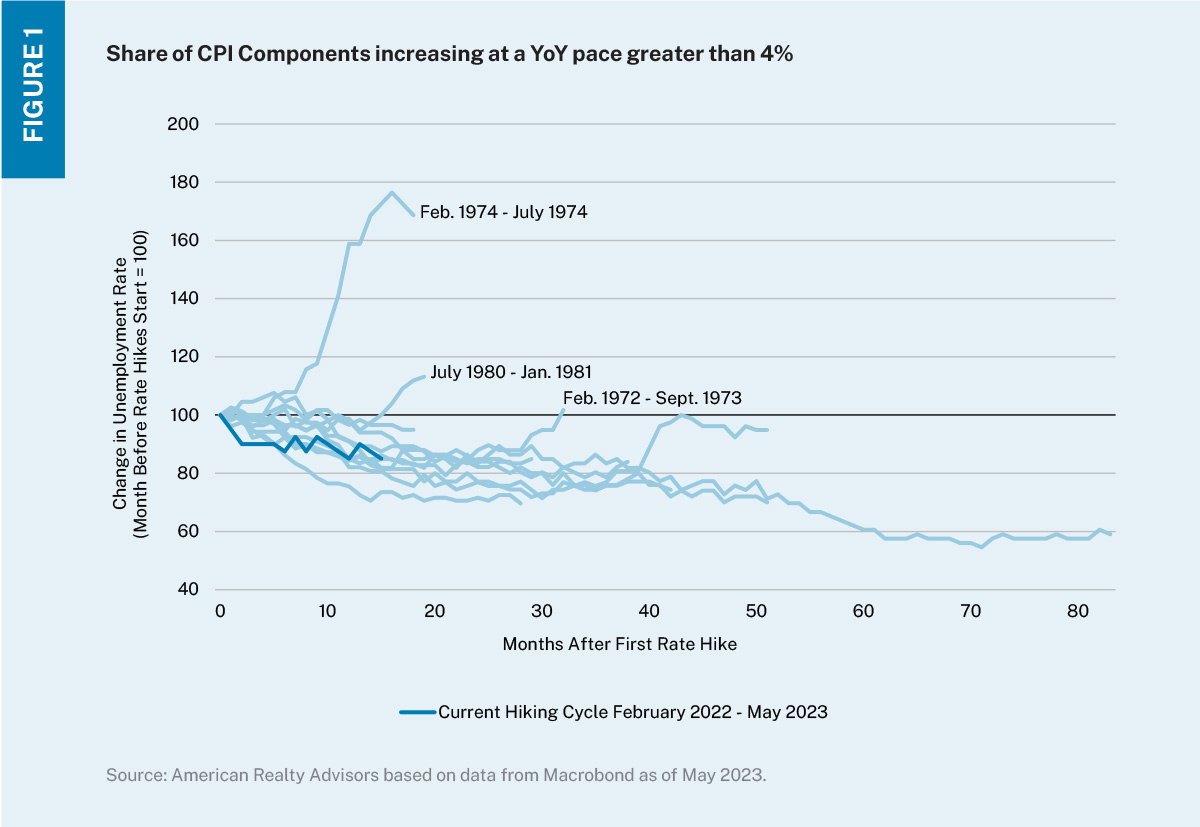

Achieving low and stable inflation is a function of a balanced labor market. As a result, when inflation is running hot, there is an expectation that tighter policy will always lead to higher unemployment to bring things back into balance. However, only three of the last 11 rate hike cycles saw unemployment exceed pre-hike levels, and it took a year after peak rates were reached to get there. Given some of the structural limitations on labor force growth, there is a possibility that we may not see unemployment exceed 5% in the near term.

Inflation

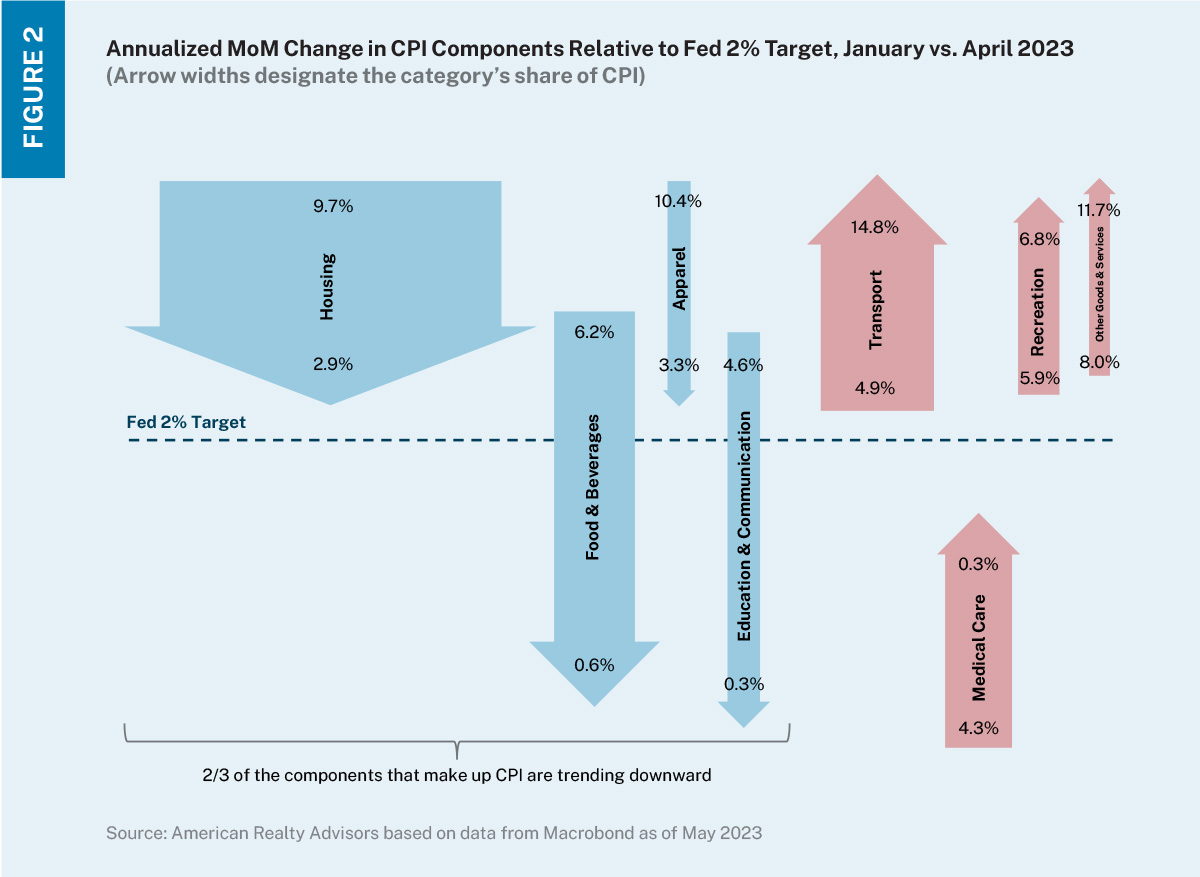

Overall CPI is still firmly above the Fed’s 2% target, but annualized month-over-month momentum in certain categories shows meaningful progress. For example, housing saw annualized month-over-month price growth decelerate from 9.7% in January to 2.9% in April.

Goods price growth (2/3rds of CPI) is slowing, suggesting inflation pressures are subsiding.

Fed Funds Rate: Peak or Plateau?

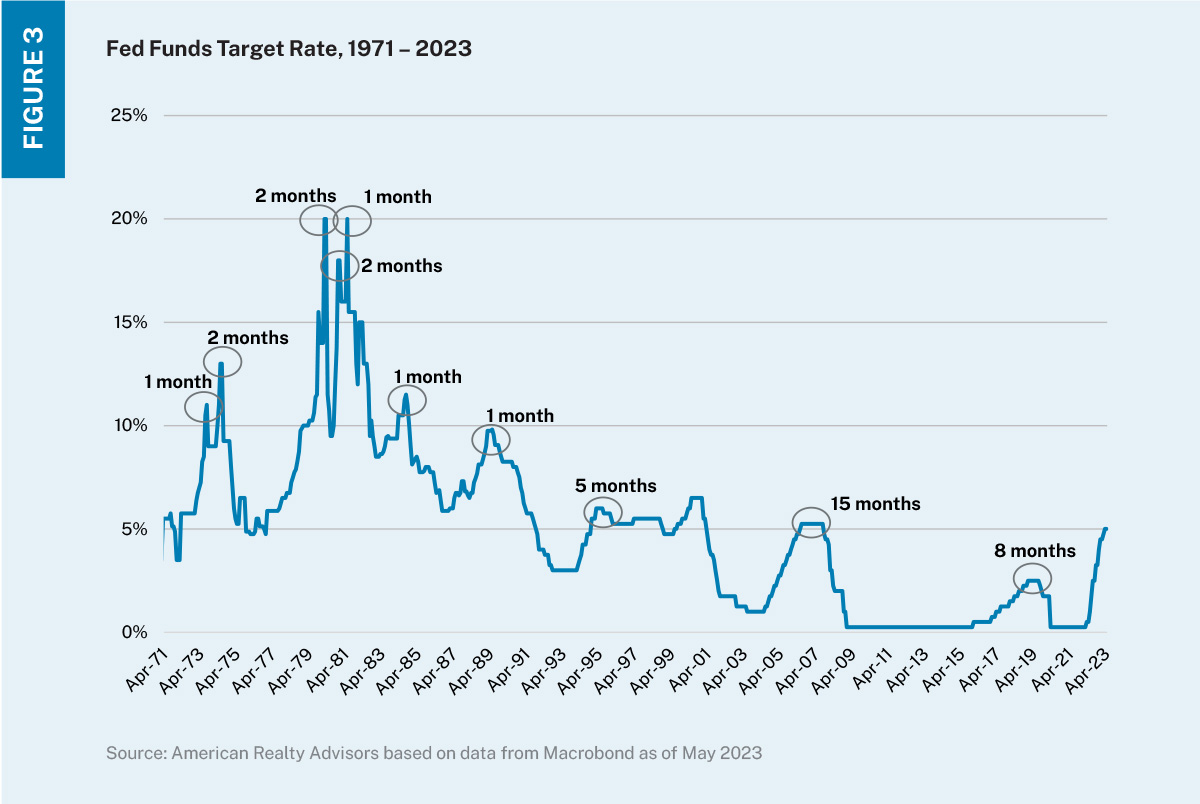

Fed policymakers have stated they may pause at peak rates for some time to allow for the lagged effects on inflation to materialize in the data. In past rate cycles, the Fed has not paused long before cutting rates – since 1971, the Fed has kept rates at peak for an average of just 3.5 months.

Our projections are for rate cuts to begin in early 2024.

Rate Hike Cycles and Appreciation

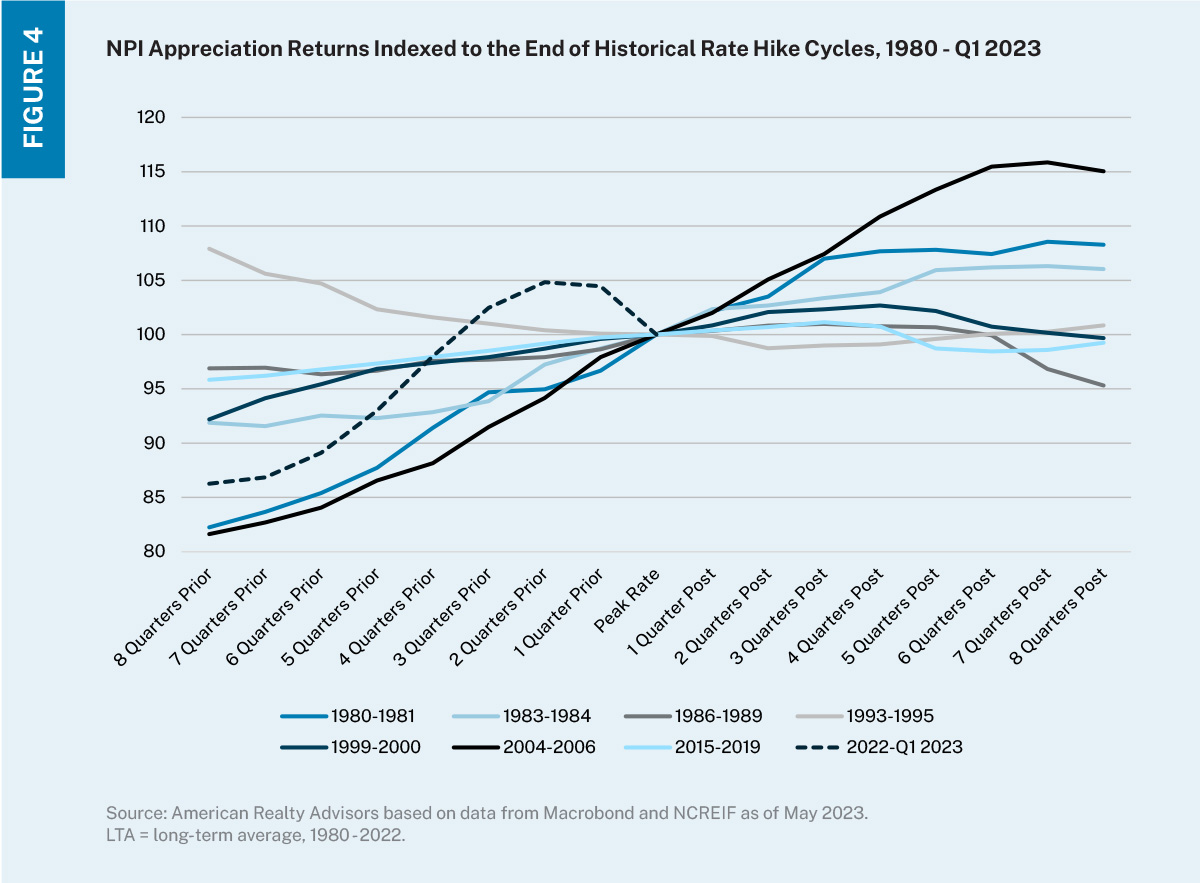

Though conditions differed surrounding peak rates, real estate appreciation tends to behave consistently after. In the last seven rate hike cycles, values were higher 86% of the time four quarters after reaching peak rates.

There is a strong likelihood that asset values will surpass current levels in the next four quarters.

Property Markets: Our Outlook

Industrial

- Declining construction starts suggests the current period of supply-demand imbalance will be relatively short lived; as a result, rent growth is expected to reaccelerate in 2024-2025.

- Not all markets’ pipelines represent the same degree of oversupply risk; many markets have meaningful preleasing levels and below-trend vacancy that should help insulate rents.

Residential

- High home prices and interest rates have further reduced for-sale affordability, creating tailwinds for rent growth.

- 2023 represents peak deliveries, which will likely moderate rent growth, though declining multifamily permit activity should create landlord-favorable conditions in 2025 and beyond.

Office

- Three years into the new working paradigm, some degree of hybrid seems to be where most employers and employees are converging.

- Though modern Class A offices appear to be doing relatively better in terms of vacancy increases, defensive measures are still required to maintain occupancy.

Retail

- Sales per square foot continue to look healthy given limited construction and increased consumption, supporting the ongoing case for retailers’ brick-and-mortar footprints.

- Recessions tend to spur more conservative spending on non-essential items, instead earmarking money for necessities like groceries.

Specialty

- With ongoing headwinds in office, we anticipate alternative subtypes to continue to grow in investors’ allocations.

- Certain specialty sectors offer above-average NOI growth prospects in the near term given lesser supply.

Summary and Strategy Implications

Fear and uncertainty often lead to generalizations about entire asset classes, but differences across markets, sectors, and assets mean there remain attractive opportunities in real estate today.

- The economy has been remarkably resilient in the face of unprecedented rate hikes, though we aren’t out of the woods yet when it comes to a possible recession.

- Consumers still have job opportunities and excess savings to draw down but will see less credit availability to turn to when they inevitably spend through it.

- Financial market volatility remains a major unknown regarding a potential downturn.

- Fundamentals are in good shape for most sectors (except office) and current tight financial markets should curtail new development, limiting supply that can reinvigorate rent growth.

- Returns, particularly appreciation, are being influenced more by exogenous lending and liquidity constraints than by state of fundamentals – until the former returns, there are likely a few more quarters of depreciation to withstand.

- There is a chance that the U.S. avoids recession, though it’s prudent to plan for downsides. We are focused on seeing beyond the immediate pricing dislocation to structural opportunities on the other side – think decades, not days.

Print Charts and Figures PDF

---

More to Explore:

---

Disclaimer

The information in this presentation is as of July 1, 2023, unless specified otherwise and is for your informational and educational purposes only, is not intended to be relied on to make any investment decisions and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This presentation expresses the views of ARA as of the date indicated and such views are subject to change without notice. The information in this presentation has been obtained or derived from sources believed by ARA to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based. Models used in any analysis may be proprietary, making the results difficult for any third party to reproduce. Past performance of any kind referenced in the information above in connection with any particular strategy should not be taken as an indicator of future results of such strategies. It is important to understand that investments of the type referenced in the information above pose the potential for loss of capital over any time period. This presentation is proprietary to ARA and may not be copied, reproduced, republished, or posted in whole or in part, in any form and may not be circulated or redelivered to any person without the prior written consent of ARA. Photos used in this presentation were selected based on visual appearance, are used for illustrative purposes only, are not necessarily reflective of all the investments made by ARA or which ARA may make in the future.

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are statements that do not represent historical facts and are based on our beliefs, assumptions made by us, and information currently available to us. Forward-looking statements in this newsletter are based on our current expectations as of the date of this presentation, which could change or not materialize as expected. Actual results may differ materially due to a variety of uncertainties and risk factors. Except as required by law, ARA assumes no obligation to update any such forward-looking statements.