Research Insights, March 10, 2023

Change Agents: Life Sciences Real Estate

Life science real estate sits at the intersection of two converging Change Agent macrotrends: sociodemographic change and technological advancement.

---

The unprecedented collaboration among the scientific community in fighting COVID-19 fueled a rapid expansion of the life sciences industry, thrusting this critical economic engine into overdrive. The rapid response in developing the vaccine has sparked renewed optimism for the prospect of developing cures and treatments for other debilitating illnesses such as Alzheimer’s and cancer, attracting capital into the sector.

While no industry is wholly recession-proof, the growing necessity of life sciences suggests sustained longer-term demand for physical space that is conducive to the highly specialized nature of scientific advancements. Life science sits at the intersection of two converging forces – technology and demographics. We expect portfolio exposure to properties positioned to capture demand from these tailwinds to increase meaningfully in the coming years, particularly as a replacement to reduced traditional office allocations.

Demand Drivers

The demands of an aging global population, the aftermath of the COVID-19 pandemic, and technological advancements continue to propel the four main life science demand drivers:

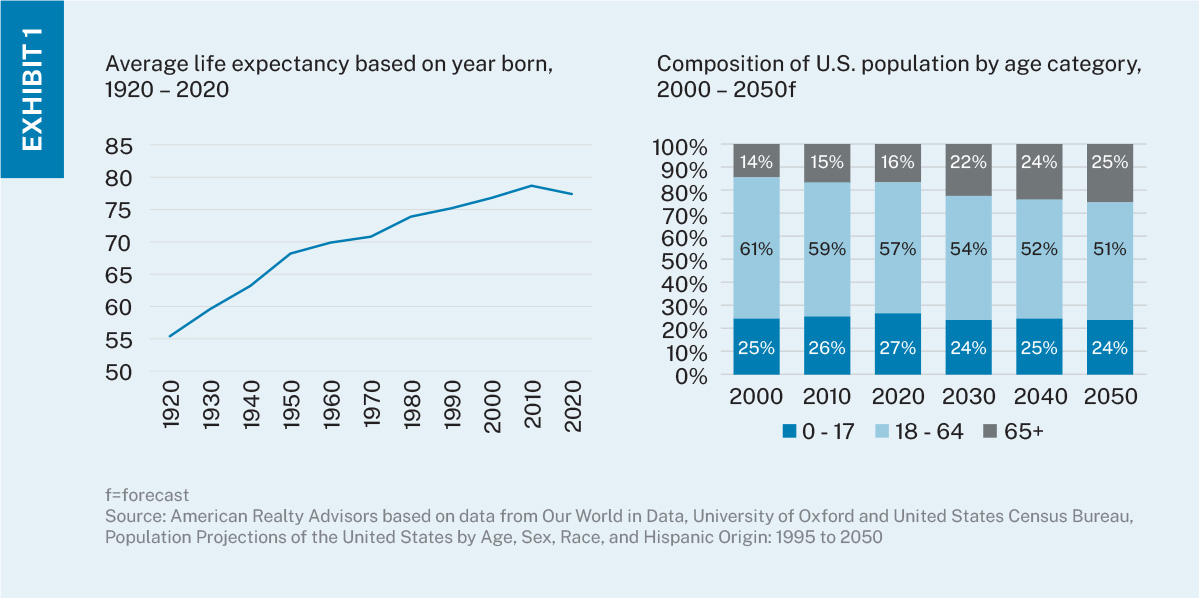

Increased Life Expectancy/Aging

Greater prevention and treatment of diseases has progressively increased longevity globally; the average American life span has increased 30% since the 1920s. An increasingly older society dictates greater quality-of-life and age-related life science research.

Globalization/Disease Control

Global connectivity of supply chains and people increases the potential for the spread of disease, as seen with COVID-19. Growth in companies focused on rapid responses to disease control, treatment, and research has never been more important.

Employment Growth

Life science employment growth has outpaced total employment growth in the United States for over a decade, with an annual average of 6.6% for the former compared to 1.2% for the latter1. Additionally, the number of students pursuing life science-related degree programs across the nation has increased by 60% over the last decade2. This growing talent pool should continue to provide employers with workers and fuel further growth in the industry.

Research Capital

COVID-19’s global reach fueled unprecedented medical collaboration that led to the fastest vaccine development in history, a feat that would not have been possible without ample funding. Venture capital, biopharmaceutical companies, and a variety of non-profit and governmental organizations have earmarked hundreds of billions in support of these endeavors, fueling space demand.

.jpg)

What Makes a Life Science Hub?

The collaborative nature of the life science industry creates highly centralized pockets where established companies cluster. Both established and emerging clusters demonstrate the following characteristics:

- Critical mass of existing talent;

- Robust talent pipeline via universities;

- Depth and maturity of existing companies;

- Access to venture capital, public, and private funding;

- Affordable cost of living and doing business; and

- Ability to expand.

.jpg)

Commercial Real Estate Implications

Life science and medical office buildings encompass different types of physical spaces that accommodate research and development, labs, diagnostic centers, and patient care. Given the broad range of space uses, spec life science builds must be able to accommodate several needs in one facility while also satisfying safety and industry requirements. The unique characteristics required by tenants are a challenge for traditional office buildings that do not easily or cheaply lend themselves to being repositioned due to structural inefficiencies.

Structural Requirements3

- Redundant Emergency Power Systems: Emergency power systems are necessary to maintain constant power for all high-tech machinery, and heating and cooling storage utilized in research experimentation.

- Higher Floor-to-Ceiling Heights: A minimum ceiling height of 16 feet is required for ventilation purposes. Ceiling heights are not easily altered in existing assets.

- Higher Floor Load Capacity: Floor loads must be able to accommodate a live load of at least 100lbs per square foot given the utilization of heavy machinery.

- Sufficient Vibration Capacity: Result accuracy is vital for life science companies, as heavy machinery may emit vibrations that impact experimental outcomes. Buildings that are not equipped to minimize vibrational movement can be considered nonfunctional.

- Superior HVAC Systems: Ventilation of hazardous chemicals is crucial. The average laboratory needs approximately six-to-eight room air changes per hour, requiring top-of-the-line HVAC systems. Existing buildings utilizing recirculated air will have to retrofit the HVAC system in order to meet minimum safety requirements.

- Vertical MEP Expansion Capabilities: Building structures must be able to accommodate vertical MEP (mechanical, electrical, and plumbing) layout and expansion in order to provide proper ventilation by means of vertical shafts that remove exhaust fumes from the facility. Existing buildings may not be able to accommodate vertical MEP without costly renovation and construction measures.

- Energy Efficient Buildings: Laboratories consume between five-to-ten times more energy per square foot than standard commercial buildings. Due to the high energy demands, those buildings that can provide sustainable energy sources will garner the lion’s share of tenant demand.

Space Requirements4

As life science companies grow, their space needs evolve based on the stage of research, source of funding, and need for office and/or manufacturing space. The multidimensional work that takes place in labs means that spaces are highly customized with “zones” for different functions; the effort required to relocate the different pieces means tenants tend to be sticky. Buildings with structural setups that can allow companies to flow between different types of uses with flexible and adaptive space will allow life science companies to both use the space more efficiently and commit to longer lease terms. This means that in a dynamic life science ecosystem, a building or campus that can cater to a companies’ ongoing growth and service firms at different stages in their life cycle may be better positioned.

.jpg)

Current State of the Life Science Sector

The life science industry has been tested and has shown resiliency in previous recessions as demand for these services has been largely resistant to slowdowns in the economy. The current economic environment should be no different.

That’s not to say there won’t be a near-term impact – only that, on a relative basis, this segment of the economy should be much more insulated. Already we are beginning to see a moderation from recent highs in the form of funding pauses (due to capital conservation) and in turn, slowing tenant demand for space. While we expect this trend to continue through the end of the year, both metrics – funding and occupier demand – remain well above historical trends. With the sector's long-term resiliency and important role in the changing economy, life science is in our view a critical and growing agent of change for both the medical industry and commercial real estate.

---

More from our Change Agents Series:

---

Notes

1 Life Science Update, October 2022, Cushman and Wakefield.

2 Ibid.

3 Tips to Designing Purpose-Built Life Science Spaces, Hines, December 2021.

4 Source: American Realty Advisors based on data from Real Estate Advisory Services, CBRE and Siras as of October 2020

Disclaimer

The information in this newsletter is as of March 10, 2023, and is for your informational and educational purposes only, is not intended to be relied on to make any investment decisions, and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This newsletter expresses the views of the author as of the date indicated and such views are subject to change without notice. The information in this newsletter has been obtained or derived from sources believed by ARA to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based. Models used in any analysis may be proprietary, making the results difficult for any third party to reproduce. Past performance of any kind referenced in the information above in connection with any particular strategy should not be taken as an indicator of future results of such strategies. It is important to understand that investments of the type referenced in the information above pose the potential for loss of capital over any time period. This newsletter is proprietary to ARA and may not be copied, reproduced, republished, or posted in whole or in part, in any form and may not be circulated or redelivered to any person without the prior written consent of ARA.

Forward-Looking Statements

This newsletter contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are statements that do not represent historical facts and are based on our beliefs, assumptions made by us, and information currently available to us. Forward-looking statements in this newsletter are based on our current expectations as of the date of this newsletter, which could change or not materialize as expected. Actual results may differ materially due to a variety of uncertainties and risk factors. Except as required by law, ARA assumes no obligation to update any such forward-looking statements.

.jpg)