Research Insights, November 16, 2022

Change Agents: Transition Plan

Forecasts about the future of the office sector are often wildly conflicting, but the looming high tide of generational leadership transitions could change the script.

---

The word “office” has become synonymous with uncertainty for real estate investors. For every data point that seems to suggest the end of the modern workplace as we know it, there is an equal number touting the benefits of in-person collaboration, with several major employers taking hard stances about return-to-work expectations. How demand and usage ultimately shake out will have lasting implications for a property type that represents a quarter of ODCE funds’ holdings.1

Beyond this data, there is another transitional force to interpret. Millennials are moving closer to peak corporate influence as they age into their prime C-suite years in the coming decade. The depth of this generational handover, and the difference in values and perspectives between the current and next cohort of leaders (and their Gen Z employees), provides an important clue about longer-term prospects for the office sector.

Leveling the Field

Two years on since the beginning of the pandemic and the massive work-from-home experiment, the majority of office occupiers have firmed up their post-pandemic return-to-work strategies, with most adopting some level of flexibility, whether begrudgingly or willingly.

The lasting effect of this has yet to fully materialize in office occupancy fundamentals, as rolling lease expirations will distribute the impact over several years. However, 2022 stands to represent the toughest test for landlords yet, as 11% of leased office space in the US is set to expire.2 How much of the roughly 900 million square feet of leased space expiring between now and 2026 will be renewed is still anyone’s guess, though the general consensus is less.

Some have argued that an economic recession could spur a more meaningful return to the office, as looser labor market conditions would shift the leverage more firmly back into employers’ hands, making a forced return to the office more viable. This silver lining has given life to the hope that this period of office demand flux could be relatively short-lived.

To believe a recession will reset the playing field is both overly optimistic and shortsighted. A looming transition in the makeup of corporate leadership by virtue of a generational handoff from Baby Boomer and Gen X managers to Millennials in the next decade stands to prevent the current office approach from backsliding, and may even reinforce it, creating meaningful implications for long-term holders of office properties.

A Coming Change-Up in the C-Suite

As corporations have grown larger and more profitable over time, boards have naturally sought to fill key leadership positions with professionals who have the depth of experience to steer these big ships; the kind of experience that comes with age. This gradual “graying” of the C-suite has created a backdrop where departures are beginning to occur with increasing frequency as the front end of the Baby Boomer generation enters retirement, leaving a sizable gap that next-in-line Gen Xers will be unable to wholly fulfill on their own.

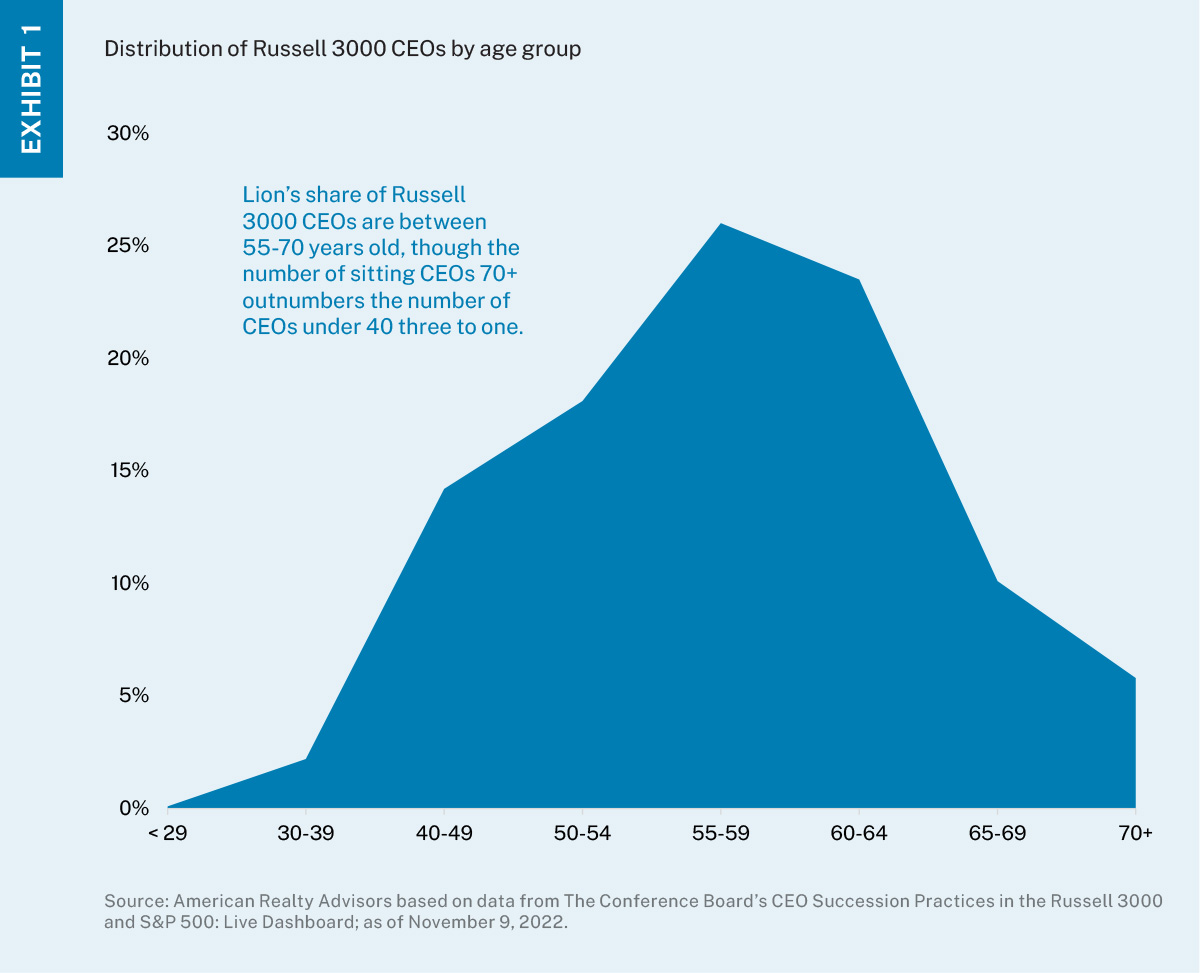

More than half (59%) of sitting CEOs in the Russell 3000 are between 55 and 70 years old; the average age of departure: 61.3 While this statistic suggests an imminent wave of change (given people are living and working longer), it is the tail ends of the distribution that mask the true depth of potential for disruption, as the number of CEOs age 70 or older outnumber those under 40 by a measure of nearly three to one (Exhibit 1).

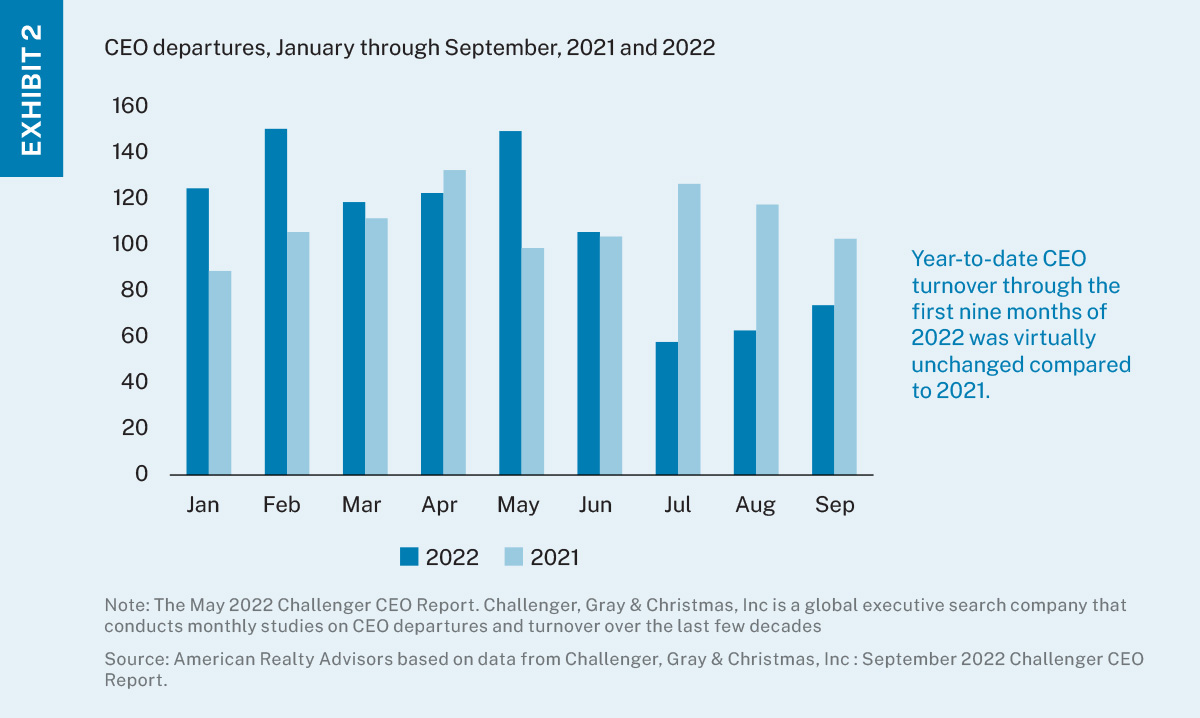

Over the last three years, nearly 4,300 companies saw turnover in their CEO position, as boards reimagined goals for their leadership and leaders reevaluated their willingness to serve in a rapidly changing business environment. And the pace is showing little signs of abating; through the first nine months of 2022, CEO turnover was essentially the same as what occurred in the same period in 2021 (Exhibit 2).

Of course, not all turnover is a function of retirement. But of the 969 CEOs that have left through September of 2022, 232 stepped into other high-level roles within the firm, 70 left for new opportunities, and 229 (or 24%) retired. As the crest of the Baby Boomer wave isn’t projected to reach retirement until 2030, the structure of corporate leadership, as well as their approaches to office space, is in the early stages of transformation.

Complementary Values

Given the inevitable importance of Millennials in filling vacant C-suite roles, the cohort’s values and struggles may provide insight into how their leadership styles may evolve, and what the corresponding impact may be on the office landscape. Millennials, like most office workers, have become accustomed to the recent work-from-home experience. This enhanced work-life balance has created a fundamental shift in the Millennial worker’s perspective on the way work can and should fit into their daily lives.

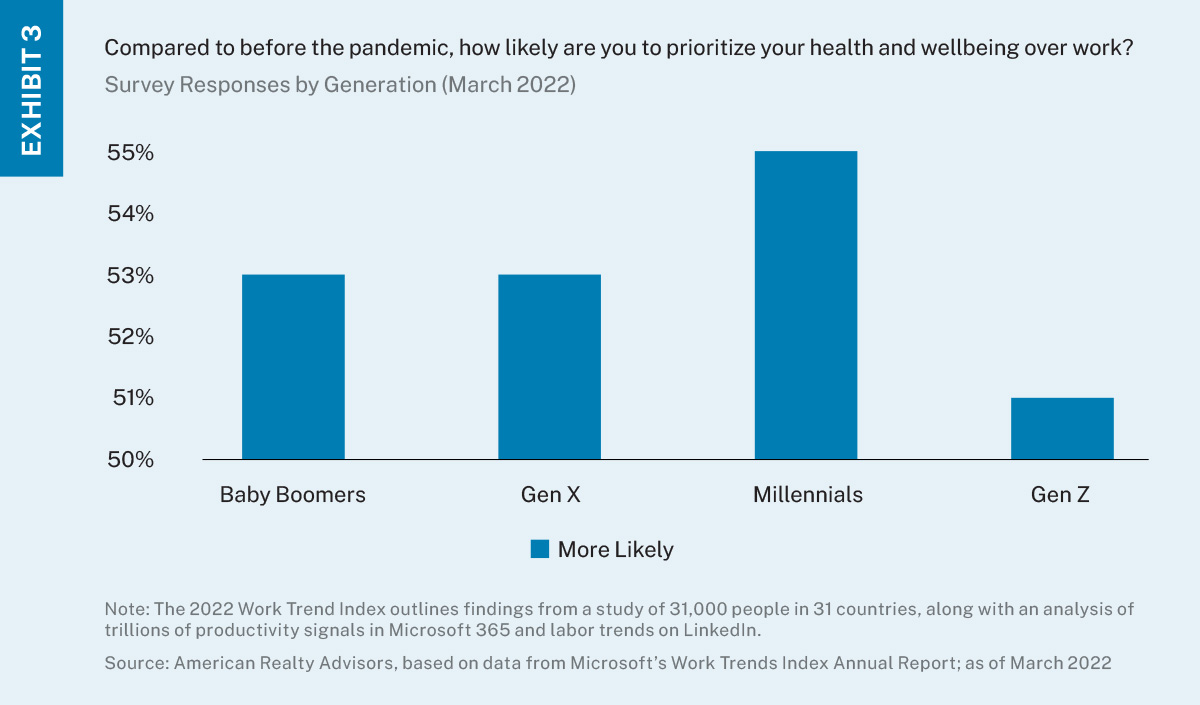

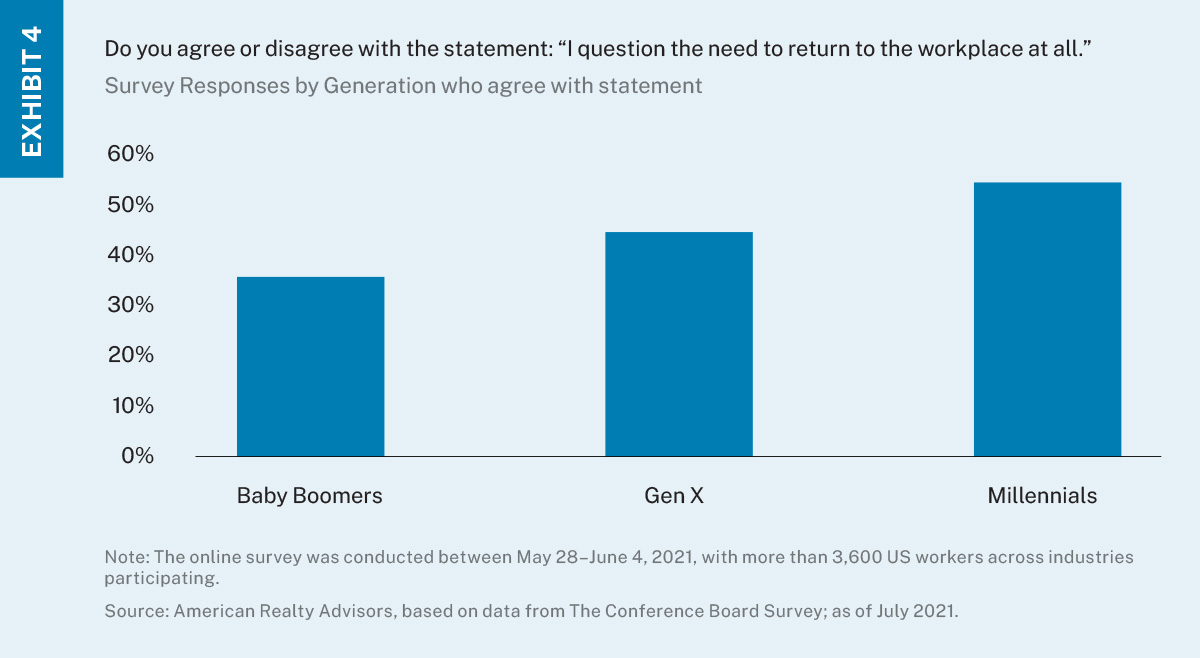

Recent survey results reflect this dramatic shift in priorities. According to the 2022 Work Trend Index4, 55% of Millennial respondents stated they are now more likely to prioritize their health and wellbeing over work than they were before the pandemic (Exhibit 3). Furthermore, when surveyed as to whether they felt there was a need to return to the office at all, 55% percent of Millennial respondents questioned the need, far outpacing the percentage of Gen X and Baby Boomer respondents who felt similarly (Exhibit 4).5

Millennials are also increasingly conscious of the positive impact work-from-home (WFH) and hybrid working could have on underrepresented groups. Millennials’ early years of employment were marked by the growing focus on corporate diversity, equity and inclusion (DEI) efforts. It is safe to bet that these value pillars will continue to drive Millennial decision-makers and their approach to office-based work.

The shutdown of schools, child, and elder care facilities during the pandemic shined a renewed light on how much progress remains to be made when it comes to gender access and equality. With women spending on average between three to six hours per day on unpaid caregiving work, compared with an average of less than two hours per day for men6, it comes as no surprise that the pandemic displaced 1.7 million more female workers than male.7 WFH allows women to remain productive while balancing domestic responsibilities and provides firms more opportunities to improve the gender labor gap. Minority, immigrant, and ably challenged groups also benefit from flexibility, as WFH may reduce the impacts of microaggressions, prejudice, and the physical demands of commuting, all of which can cause employee burnout and impair well-being.

Through the dual lenses of work-life balance and greater labor equity, Millennials appear poised to add further challenge to the traditional office model when they inevitably step into leadership roles. Yet the desires of the subsequent generation (Gen Z) and the need for Millennial leaders to cater to this cohort, suggest the conclusion is not as clear cut. While the younger generation clearly values WFH flexibility (Gen Z is 77% more likely to engage with a job posting on LinkedIn if it states flexibility in the description), many are only beginning their professional careers and greatly fear they will miss out on pivotal professional development by not being in the office. Additionally, 41% of Gen Z respondents fear that fully remote work will prevent them from building relationships, receiving mentoring, and even being promoted due to possible “out of sight, out of mind” mindsets amongst leadership.8

These are specific generational preferences that will influence the future of office in the coming decade, but there are also more practical elements that come with every new generation entering the workforce that suggest a level of permanence. With many new graduates living with family or roommates, offices provide younger generations with dedicated workspaces that they don’t have at home—spaces less useful or necessary for more senior colleagues.

With many firms currently operating in a hybrid model, this standard appears to best meet current and future employee demands for WFH flexibility and corporate community. Though the pandemic has shown that some work can be done asynchronously, many firms are expected to maintain a central location for collaboration and knowledge sharing. Furthermore, the office fulfills workers’ social needs. This is a critical component to holistic wellbeing that has been proven to increase productivity and morale and reduce employee turnover. When asked to compare their social wellbeing, 50% of fully remote respondents reported feeling lonelier than they had pre-pandemic.9

It is safe to say we are already getting a glimpse into what the future of office will look like under Millennial leadership. Though there has been some reluctance to embrace the current environment as the new stasis, the pandemic’s impact is too great and too ingrained to not have a lasting effect. As worker values have drastically changed over the past two years, it appears there is no going back to the office of the past, especially for younger generations.

---

More from our Change Agents Series:

---

Notes

1 NCREIF Fund Index – Open End Diversified Core Equity (NFI-ODCE) as of 1Q 2022.

2 JLL data as of April 2022.

3 The Conference Board’s CEO Succession Practices in the Russell 3000 and S&P 500: Live Dashboard; as of November 9, 2022.

4 2022 Work Trend Index compiles findings from a study of 31,000 people in 31 countries, along with analyses of trillions of productivity signals in Microsoft 365 and labor trends on LinkedIn.

5 “Survey: Amid Higher Productivity, 43 Percent of US Workers Question Need to Return to Workplace”, The Conference Board, July 2021.

6 “Unpaid Care Work: The Missing Link in the Analysis of Gender Gaps in Labour Outcomes”, Gaelle Ferrant, Luca Maria Pesando, and Keiko Nowacka, OECD Development Center, December 2014.

7 “As Women Return to Jobs, Remote Work Could Lock in Gains,” Tim Henderson, The PEW Charitable Trusts, May 2022.

8 “Younger Employees Fear Being Left Behind by Remote Work,” Erica Pandey, AXIOS, July 2021.

9 “Great Expectations: Making Hybrid Work Work”, Microsoft 2022 Work Trend Index, March 2022.

Disclaimer

The information in this newsletter is as of November 9, 2022, and is for your informational and educational purposes only, is not intended to be relied on to make any investment decisions, and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This newsletter expresses the views of the author as of the date indicated and such views are subject to change without notice. The information in this newsletter has been obtained or derived from sources believed by ARA to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based. Models used in any analysis may be proprietary, making the results difficult for any third party to reproduce. Past performance of any kind referenced in the information above in connection with any particular strategy should not be taken as an indicator of future results of such strategies. It is important to understand that investments of the type referenced in the information above pose the potential for loss of capital over any time period. This newsletter is proprietary to ARA and may not be copied, reproduced, republished, or posted in whole or in part, in any form and may not be circulated or redelivered to any person without the prior written consent of ARA.

Forward-Looking Statements

This newsletter contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are statements that do not represent historical facts and are based on our beliefs, assumptions made by us, and information currently available to us. Forward-looking statements in this newsletter are based on our current expectations as of the date of this newsletter, which could change or not materialize as expected. Actual results may differ materially due to a variety of uncertainties and risk factors. Except as required by law, ARA assumes no obligation to update any such forward-looking statements.