Research Insights, February 22, 2022

Change Agents: Millennial and Gen Z Influence on Real Estate

Identifying what the next generation will want from their real estate has long been the silver bullet of property investing. To get it right, one needs to not only have an asset that caters to these evolving preferences, but also to be positioned to do so at precisely the right time.

PDF interactivity only available on desktop. Continue reading below for mobile-friendly web version.

---

There have been numerous pieces written about what the rising influence of the Millennial cohort (and Gen Zs behind them) would mean for the world around us – and yet, the general result of these efforts has been largely superficial. A quick search for “Millennial influence on the workplace”, for example, will yield results falling into one of two categories: those pieces focused on company’s efforts to recruit these cohorts via enhanced lifestyle offerings like free gym memberships, in-office snacks, beer taps, and nap pods, and those highlighting the group’s inclination for flexibility and purpose.

That’s not to say the conclusions have yielded nothing; rather, they suggest that the function of all forms of real estate must continue to evolve. But now, with several decades of data on Millennial and Gen Z perspectives and habits and with both groups entering pivotal periods of their lives in the coming decade, we’re ready to take the conversation on their impact one step further, connecting the dots between who they are, what we know, and why it matters for investors in commercial real estate.

Who They Are

Although the focus of this piece is the impact of a strengthening Millennial/Gen Z influence on the various corners of the commercial real estate universe, it’s useful to place them in the appropriate generational context to better isolate changes in attitudes and values over time.

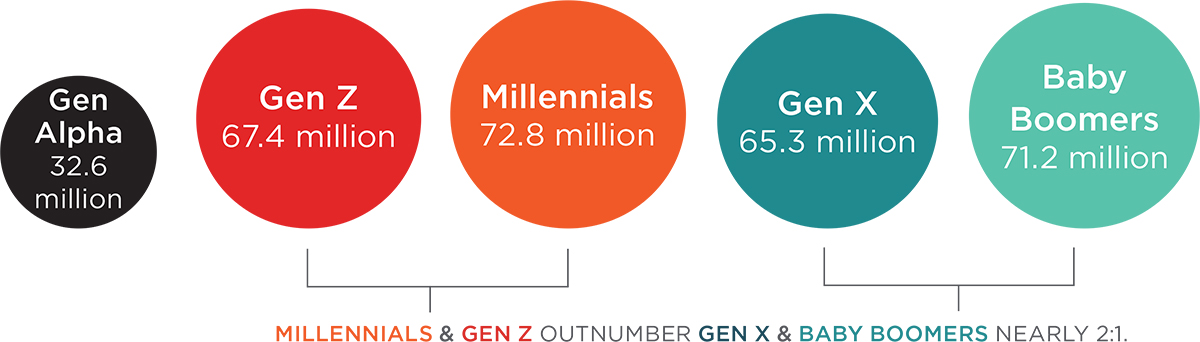

Millennials (also known as Gen Y) are the children of Baby Boomers and Gen Xers, generally born between 1980/1981 through the mid-1990s. These individuals came of age during the expansion of access to the internet, though still remember the days before the internet and internet-enabled cell phones. Critical formative events include 9/11, the Afghan and Iraq wars, and the GFC. Estimated cohort size in 2020: 72.8 million

Gen Z are those born between 1997 and 2012. The beginning bracket year for this cohort is firmer and generally agreed upon by demographers given those born after 1996 did not experience the same political, economic and social factors that defined the Millennial generation’s formative years.1 Gen Z is arguably the first truly digitally-native cohort, with the iPhone launching at a time when the older Gen Zers were just 10 years old. Estimated cohort size: 67.4 million

Gen Alpha is the newest and youngest cohort, the ultimate size of which is still to be determined, though at latest count totaled over 30 million. The oldest in this group will be turning 10 this year. While it will be another 15-20 years before their influence is felt in the real estate market, the Gen Alpha-Millennial child-parent relationship means we may be getting a glimpse into the farther-out future through the latter’s influence. Estimated cohort size: 32.6 million

Gen X is generally defined as those born between 1965 and 1980, sandwiched between the larger Baby Boomer and Millennial cohorts. With the nuclear family changing to include more dual-income, single-parent and divorced households than the previous generation, Gen Xers spent more time unsupervised – even today, this cohort is described as particularly independent and resourceful since they were accustomed to caring for themselves. Though their youth coincided with the emergence of the first personal computer, the role of technology during Gen Xers’ formative years was relatively minimal. Less inclined to company loyalty and excessive hours, Gen Xers have been dubbed the “work hard, play hard” generation. Estimated cohort size: 65.3 million

Baby Boomers were born between 1946 and 1964. The first generation born in the post-WWII era, these individuals came of age during a period of strong economic and population growth. Post-war optimism and economic prosperity (and healthy support from governmental G.I. bills) formed the basis of the classic “American Dream” which underpinned Baby Boomers’ focus on achieving job stability and home ownership (Baby Boomers actually invented the term “workaholic”). Even today, Baby Boomers own 44% of homes in the U.S., despite accounting for less than a quarter of the overall population. Estimated cohort size: 71.2 million

Why It Matters

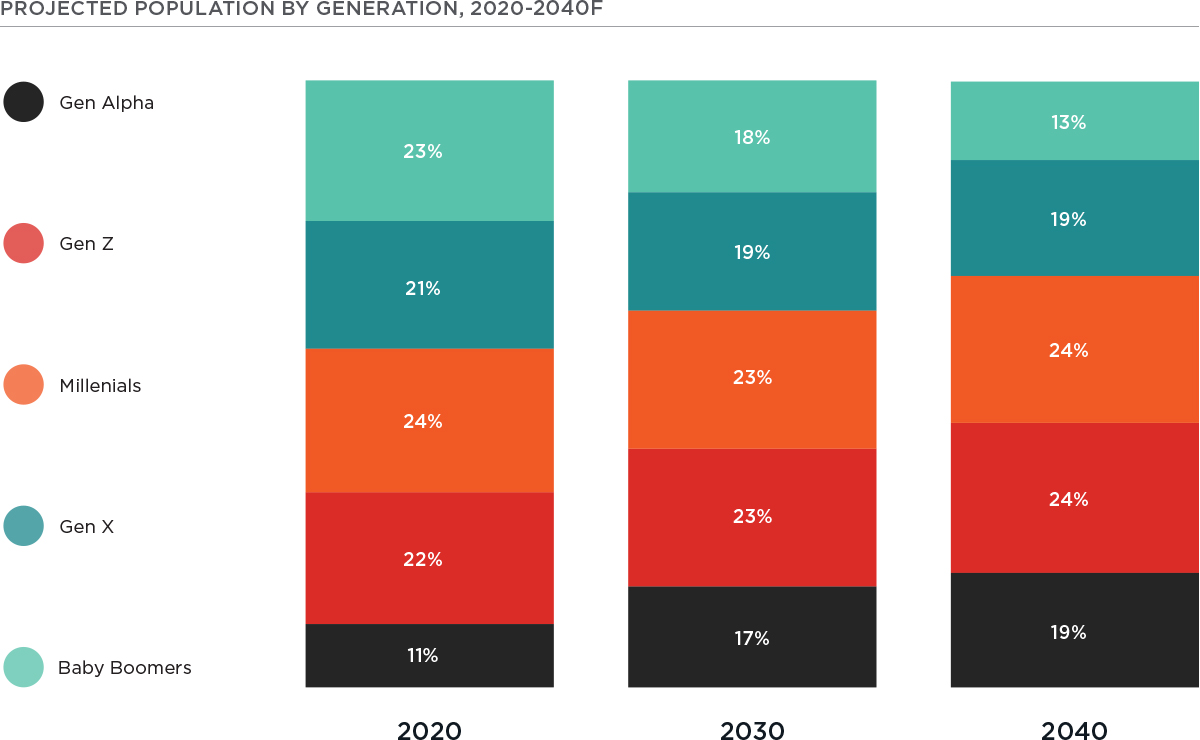

Even though Millennials overtook Baby Boomers as the largest generation in the workforce in 2016, their relevance, particularly as it relates to altering office demand patterns, is only beginning.

While companies have sought to cater to the Millennial worker given their outsized share of the labor force, decisions surrounding the type and location of the physical office has continued to be dominated by leaders from prior generations. And although certain companies who rely heavily on tech-savvy younger workers have taken their lead when it comes to embracing lower-cost metros and flexible work arrangements out of necessity, many more “traditional” office-using industries have continued to anchor their approach to one most aligned with existing Baby Boomer leadership.

But the next generation of leaders has already started to take the mantle as Millennials step into more senior roles. As of 2020, Millennials made up roughly 8.9 million of the roughly 27 million people employed in management, business and financial operations positions.2 And with 30% held by those aged 55 and older, there will be too big a gap to fill exclusively by Gen Xers as more Baby Boomers retire, suggesting a pivotal transition that will drive corporate decision making over the next 5-10 years.

Gen Z and Millenials: What We Know and What It Suggests

While preferences naturally evolve as people age, meaningful geopolitical, economic and social events during a cohort’s lifetime underpin deeply held generational values that are hard to shake. These influences and values provide a solid starting point to connect the dots to future CRE implications.

Crushing student loan debt burdens

- What we know: A combined 5.5 million Millennials and Gen Zers are saddled with $616 billion of student loan debt.3 While it’s actually Gen Xers that hold the greatest share of the overall national student debt (accounting for $601.7 billion, or 38% of the combined $1.57 trillion tally), Millennial and Gen Zers’ earning potential has been more severely stunted by two economic crises during their early professional years – one economic, the other epidemiological – from which they've yet to fully recover.

- Why it matters: Compared to prior generations, Millennials and Gen Z may have fewer opportunities (and reasons) to upsize into the suburban McMansions held by Baby Boomers without a meaningful reset in prices; instead, they may opt to focus on first homes that they can stay in longer. Others may prefer to stay homeownership-adjacent via single-family rentals whereby they can test drive some of the responsibilities of ownership without the big initial investment.

- More to explore: What would happen to the for-sale and for-rent markets if a widespread loan forgiveness program gained congressional approval? Will Gen Z feel inclined to rent as long as Millennials have? Will more of Gen Alpha forego traditional four-year degrees given the burden of their parents’ education?

Digitally native

- What we know: While the first iPhone debuted as Millennials were reaching middle school, Gen Z is the mobile-first generation: 22% of the cohort got their first smartphone before the age of 10, and 61% got theirs between 11 – 17. Both cohorts’ inclination to communicate, work, transact and socialize online has propelled older generations to follow suit.

- Why it matters: Segments of the economy previously thought of as “online-resistant” will see continued evolution as industries seek to meet Millennials and Gen Zers where they are (everywhere and nowhere). The physical spaces housing gyms, bulk discount stores, doctor’s offices, and banks will require reimagining as this group seeks to streamline routine parts of daily life online.

- More to explore: Is there a level at which online penetration of goods and services categories tops out? How will these digitally native cohorts balance their desire for increasingly quicker delivery against the ecological impacts of e-commerce?

Prioritize purpose

- What we know: Millennials and Gen Z are looking for roles that align with their personal values and are willing to make changes to find them – according to the OECD Employment Outlook 2021, 49% of Millennials surveyed (and 56% of Gen Z) said they planned to look for a new job within the next twelve months, compared to 18% of Baby Boomers.

- Why it matters: A shift from employee to employer in the coming years means Millennials (and Gen Z after) will be able to align the companies under their leadership to their principles. Expect companies to embrace radically progressive policies in terms of benefits (like student loan forgiveness) and be unwavering in their willingness to only occupy spaces that actively create positive impacts on the planet (highest LEED certification, carbon neutrality).

- More to explore: Will Millennial leaders really prioritize purpose over profits once they’re in the driver's seat? Are only tech companies really positioned to embrace fully location-less workers?

Flexibility

- What we know: Today, only 19% of employees work flexible schedules when it is most convenient for them, yet 47% see this arrangement as ideal.4 In fact, more than 60% of Gen Z and Millennials said they would switch jobs for the option to work remotely even if their salary and job description remained the same.5

- Why it matters: With companies already being forced to incorporate some level of flexibility amidst proof-of-concept during the pandemic, the Millennial takeover of the C-Suite will solidify flexible work arrangements as the norm across industries. Beyond hybrid days-in-office approach, Millennial leaders (with the support of their Gen Z mid-level managers) may promote multi-city rotations, unanchored-location salaries and flex scheduling.

- More to explore: How can companies account for cost-of-living differences if employees are market-fluid? Is it ethical to pay different wages for the same work purely based on location? How will cities and states approach taxation for nomadic W-2 employees?

Key Takeaways

1. A generational handover in the C-Suite between Baby Boomers and Millennials in the coming years will mark a shift in corporate ethos and see values at the forefront of physical space decisions, benefitting properties that make communities better.

2. Two early-career recessions have created deep earnings scarring for Millennials and Gen Z, which has delayed the purchase of starter homes. Ownership-adjacent strategies like single-family rentals allow renters to try before they buy. These cohorts may buy fewer homes in their lifetime than prior generations as a result.

3. Millennial leaders, with Gen Z behind them, will lean on technology even more as a tool for bettering work-life balance. We expect this to translate to greater nomadic workforce mobility between cities and time zones.

4. Previously “Amazon-proof” goods and services are prime for mobile disruption, which could leave behind a wake of underutilized space for repositioning.

---

More from our Change Agents series:

Supply Chain Technology: explore four technologies we expect will impact the spaces needed to manufacture and distribute goods.

Navigate What’s Next: introducing ARA’s Change Agents thought leadership series.

---

Notes

1Pew Research Center, “Defining generations: Where Millennials end and Generation Z begins”. 2Bureau of Labor Statistics, Labor Force Statistics from Current Population Survey, data as of 2020. 3Education Data.org, Student Loan Debt by Generation as of October 2021. 4) 5) Adobe, The Future of Time report. 4Adobe, The Future of Time report. 5Adobe, The Future of Time report.

Disclaimer

The information in this newsletter is as of February 17, 2022 and is for your informational and educational purposes only, is not intended to be relied on to make any investment decisions, and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This newsletter expresses the views of the author as of the date indicated and such views are subject to change without notice. The information in this newsletter has been obtained or derived from sources believed by ARA to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based. Models used in any analysis may be proprietary, making the results difficult for any third party to reproduce. Past performance of any kind referenced in the information above in connection with any particular strategy should not be taken as an indicator of future results of such strategies. It is important to understand that investments of the type referenced in the information above pose the potential for loss of capital over any time period. This newsletter is proprietary to ARA and may not be copied, reproduced, republished, or posted in whole or in part, in any form and may not be circulated or redelivered to any person without the prior written consent of ARA.

Forward-Looking Statements

This newsletter contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are statements that do not represent historical facts and are based on our beliefs, assumptions made by us, and information currently available to us. Forward-looking statements in this newsletter are based on our current expectations as of the date of this newsletter, which could change or not materialize as expected. Actual results may differ materially due to a variety of uncertainties and risk factors. Except as required by law, ARA assumes no obligation to update any such forward-looking statements.