Research Insights, December 20, 2021

Change Agents: Technology that Will Impact Industrial Real Estate

Warehouse Robotics Fall into One of Two Primary Functions:

1. Handeling of Goods

2. Movement of Goods

Robots:

As the second largest private employer in the country, Amazon raising its average wage to $18/hour for warehouse workers puts pressure on other occupiers to do the same in order to remain competitive. Robotics may help ease the cost squeeze and fill some of the gap.

Autonomous Trucking (AT):

The U.S. is estimated to be short ~80,000 truck drivers.2 With above-average occupational turnover of 92% meaning nine out of every 10 drivers won’t be working for the same company a year from now3, logistics companies are investing heavily in alternative solutions.

Autonomous Trucks Can:

• Double the daily range of a given truck by reducing legal drive time limits.

• Reduce accidents by mitigating human error.

• Cut costs by 45% upon reaching full autonomy4.

3D Printing:

As 3D printers become more affordable, they could replace the manufacture and storage of certain products, particularly lower volume, high value or highly customizable goods such as consumer electronics, specialty apparel, and mechanical parts.

Drones:

Solving for the last mile is critical to retailers. Drones offer flexibility, speed, lower costs and can potentially reduce short, inefficient fossil-fuel powered vehicle trips.

Drones In Action:

Through their investment in DroneUp, Walmart is off and running with drone delivery operations. The hubs (located in three stores across Northwest Arkansas) will operate from 8AM-8PM seven days per week with the goal of delivering to eligible customers by air in as little as 30 minutes5.

What It Means for Commercial Real Estate:

While these technologies may help solve challenges for logistics companies, they may provoke occupiers to utilize space in new ways and require different specifications for their warehouses, creating new ones for investors in industrial real estate to consider. If...

• …autonomous trucks allow for goods to travel further in a day, will occupiers need fewer facilities to distribute from?

• …more companies deploy robots to replace manual labor, will location decisions be based on access to more highly skilled labor to service the

machines?

• …drone use becomes widespread, will facilities need to accommodate landing docks on the roof? Will future development go vertical instead of

horizontal?

• …3-D printing increases in adoption, will it create a net reduction in demand for warehouse space to store finished goods?

We are focused on tracking the ROI of these technologies for first movers, as this will signal potential mass adoption curve timelines and thus downstream effects on industrial real estate.

Notes

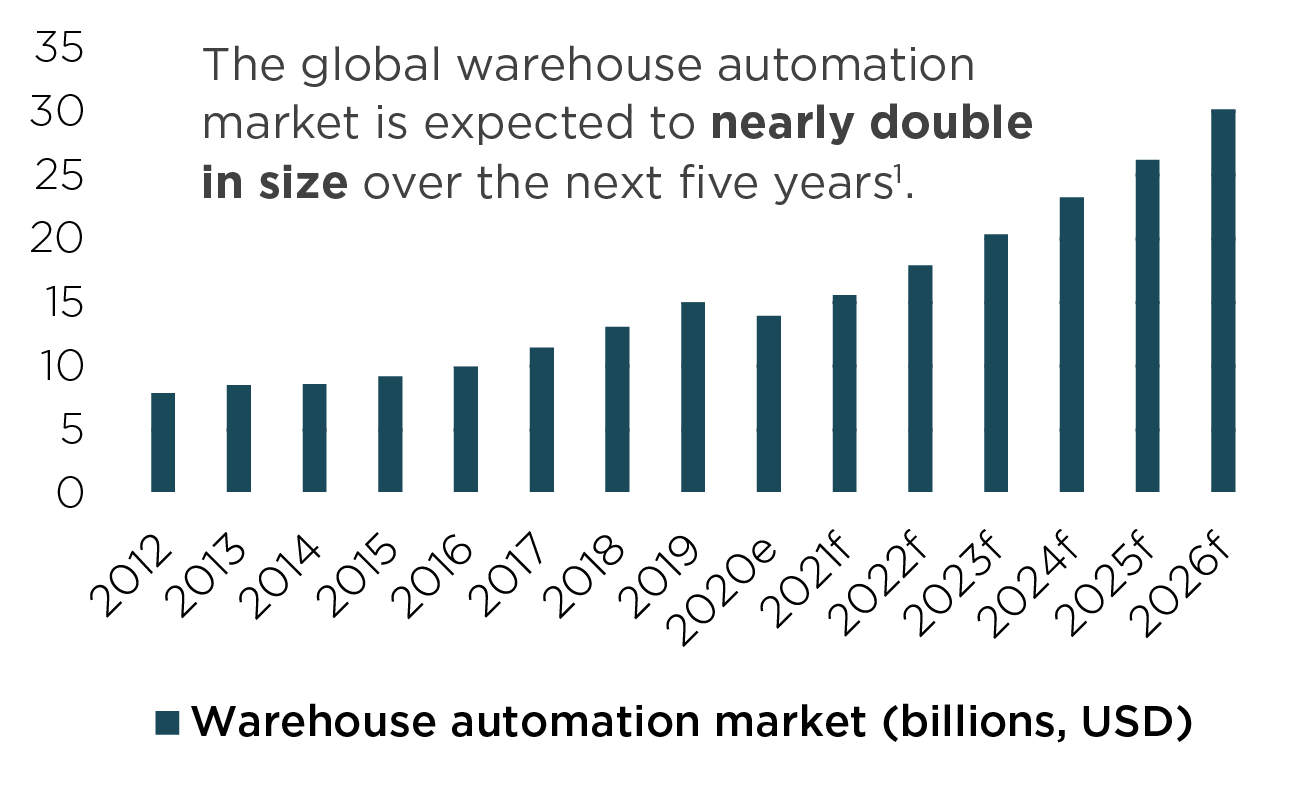

1LogisticsIQ Warehouse Automation Market study as of 2021. 2American Trucking Associations as of October 2021. 3For fleets with more than $30 million in annual revenue. Source: American Trucking Associations’ Quarterly Employment Report as of Q4 2020. 4McKinsey & Company “Distraction or disruption? Autonomous trucks gain ground in US logistics” December 10, 2018. 5Aviation Pros “Walmart and DroneUp Announce First Multi-Site Commercial Drone Delivery Operations” November 29, 2021.

Disclaimer

The information in this newsletter is as of December 2021 and is for your informational and educational purposes only, is not intended to be relied on to make any investment decisions, and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This newsletter expresses the views of the author as of the date indicated and such views are subject to change without notice. The information in this newsletter has been obtained or derived from sources believed by ARA to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based. Models used in any analysis may be proprietary, making the results difficult for any third party to reproduce. Past performance of any kind referenced in the information above in connection with any particular strategy should not be taken as an indicator of future results of such strategies. It is important to understand that investments of the type referenced in the information above pose the potential for loss of capital over any time period. This newsletter is proprietary to ARA and may not be copied, reproduced, republished, or posted in whole or in part, in any form and may not be circulated or redelivered to any person without the prior written consent of ARA.

Forward-Looking Statements

This newsletter contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are statements that do not represent historical facts and are based on our beliefs, assumptions made by us, and information currently available to us. Forward-looking statements in this newsletter are based on our current expectations as of the date of this newsletter, which could change or not materialize as expected. Actual results may differ materially due to a variety of uncertainties and risk factors. Except as required by law, ARA assumes no obligation to update any such forward-looking statements.