Research Insights, December 04, 2023

Change Agents: Single Family Rental Communities Are Giving Millennials a Way to Come Home

.jpg)

A new set of challenges to homeownership is reshaping the way investors approach their rental residential portfolios.

---

Millennials are charting a course through a housing landscape that is both familiar and new. While their hopes for homeownership echo those of previous generations, the financial landscape they must navigate to get there is markedly different, complicating their journey toward the American Dream. From staggering student loan debt to increasing home prices, a new set of challenges is reshaping the way Millennials approach the concept of home and the way investors approach their rental residential portfolios.

Student Debt

One of the most oft-cited roadblocks to Millennial homeownership is mounting student loan debt, despite some post-pandemic forgiveness.

.png)

Rising Home Prices

Over the last two years, an 18% average growth in incomes has failed to keep pace with the increase in home prices (Figure 1).4 This widening gap between income levels and home prices has kept homeownership increasingly unattainable for Millennials, especially in markets that seemingly offer better employment prospects, like Austin, where home prices have risen 116% over the last decade.5

.png)

Supply Constraints

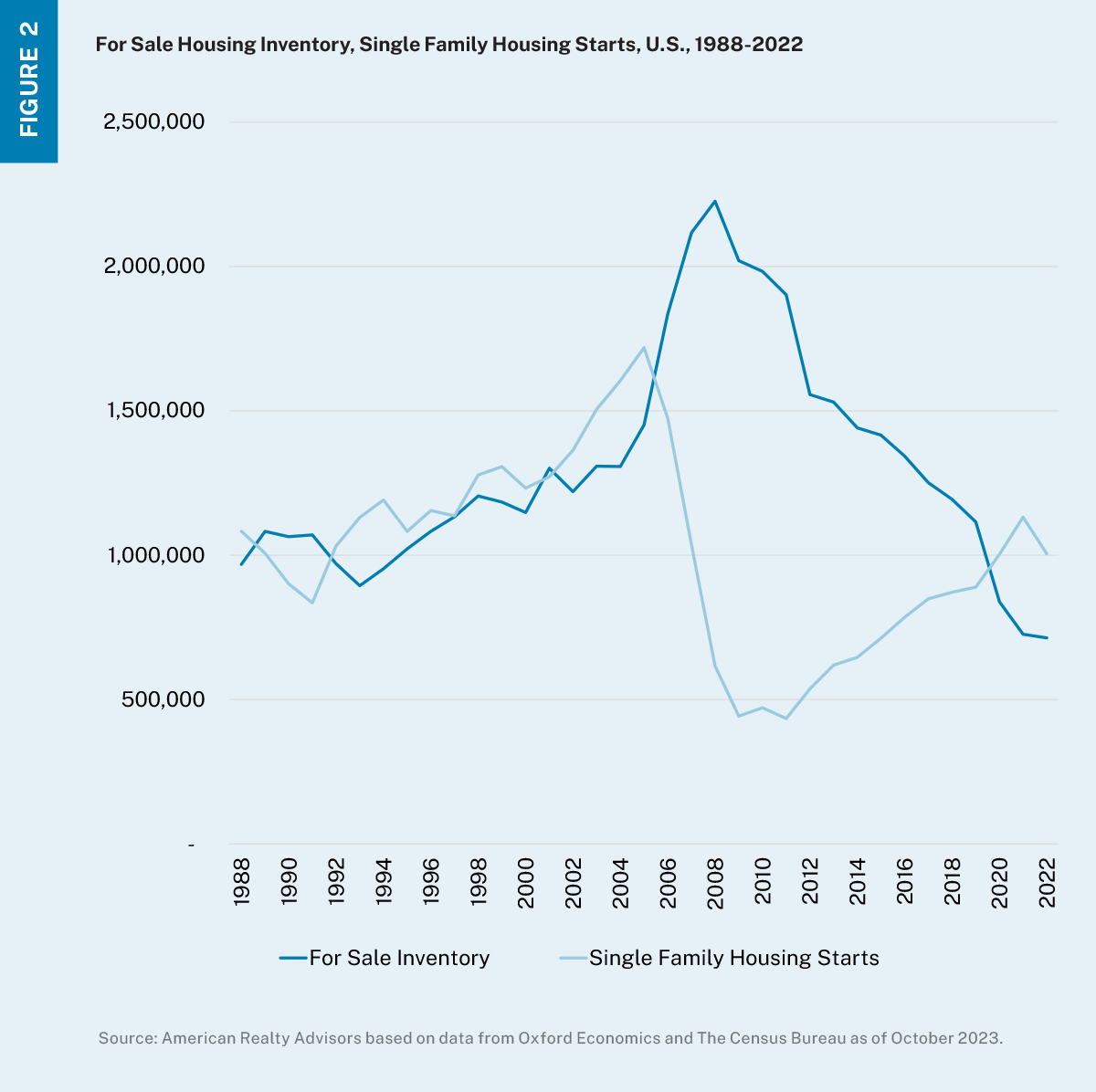

The challenge of rising home prices is unlikely to subside in the medium term. A constrained amount of for-sale inventory, declining permitting activity, and moderating new home starts is expected to continue to push prices higher (Figure 2).

The confluence of limited for-sale supply, rising home prices and burdensome student loan payments has spurred a greater deferral of homeownership for Millennials. Given limited alternatives, this generation has instead been shoehorned into renting for longer as a more economical solution.

Investor Opportunity

Given that these barriers to homeownership Millennials face are not likely to subside meaningfully anytime soon, understanding this evolution in demand is essential to making enduring investments in a changing residential sector. This presents an opening for investors to deliver on new ways of satisfying the needs of an expanding set of renters.

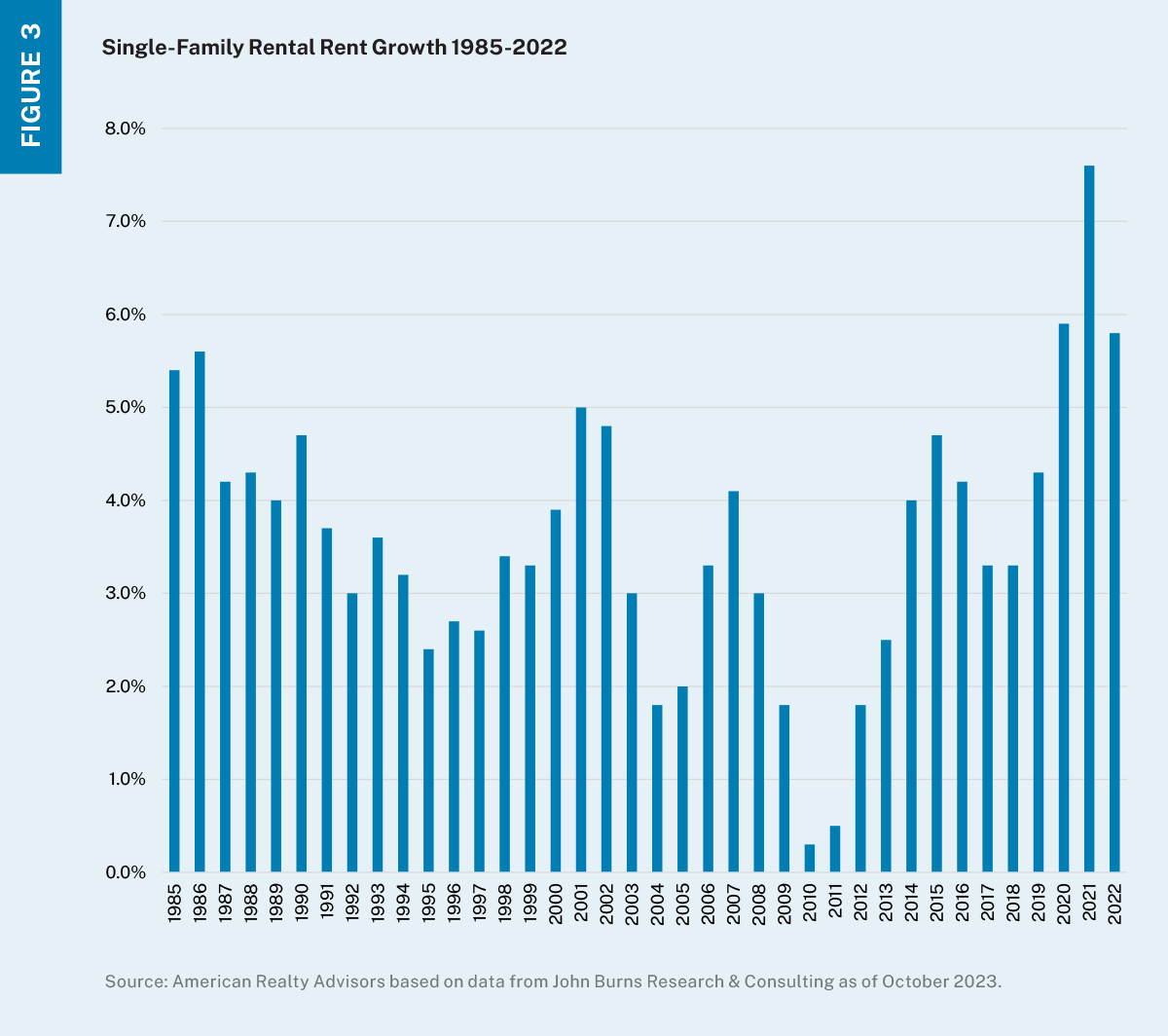

For ARA, that has come in the form of purpose-built single-family rental (SFR) communities. This variation delivers on many of the characteristics Millennials want in a purchased home: larger units, backyards and garages, and an overall more suburban feel, with the conveniences and low-cost barriers-to-entry of traditional apartments. SFRs offer a viable-yet-flexible path to experiencing the benefits of homeownership, creating a reliable and sticky tenant base. This bears out in the durability of SFR rent growth. At no point since 1985 have national SFR rents ever contracted, despite this period including several recessions and different housing cycles (Figure 3).

Ultimately, the dream of a white picket fence hasn’t faded; it’s just been repainted in more contemporary hues.

Millennials still crave the hallmarks of a traditional home – a yard for the dog, a garage for storage, home office space, and enough room to raise a family. And given the maze of financial hurdles Millennials are facing, single-family rentals are emerging as a bright spot for a generation in search of both traditional comforts of homeownership and the economic – and locational – flexibility of renting. SFR delivers on these quintessential American dreams without the long-term commitment or financial burden of a mortgage.

---

More from our Change Agents Series:

---

Notes

1 Horymski, Chris. “Average Consumer Debt Levels Increase in 2022.” Experian. 24 Feb. 2023.

2 Hanson, Melanie. “Average Student Loan Payment.” Education Data Initiative. 30 May 2023.

3 Ibid.

4 Oxford Economics.

5 Zillow Home Value Index (ZHVI All Homes (SFR,Condo/Co-Op) Time Series, Smoothed, Seasonally Adjusted).

Disclaimer

The information in this newsletter is as of December 1, 2023, and is for your informational and educational purposes only, is not intended to be relied on to make any investment decisions, and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This newsletter expresses the views of the author as of the date indicated and such views are subject to change without notice. The information in this newsletter has been obtained or derived from sources believed by ARA to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based. Models used in any analysis may be proprietary, making the results difficult for any third party to reproduce. Past performance of any kind referenced in the information above in connection with any particular strategy should not be taken as an indicator of future results of such strategies. It is important to understand that investments of the type referenced in the information above pose the potential for loss of capital over any time period. This newsletter is proprietary to ARA and may not be copied, reproduced, republished, or posted in whole or in part, in any form and may not be circulated or redelivered to any person without the prior written consent of ARA.

Forward-Looking Statements

This newsletter contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are statements that do not represent historical facts and are based on our beliefs, assumptions made by us, and information currently available to us. Forward-looking statements in this newsletter are based on our current expectations as of the date of this newsletter, which could change or not materialize as expected. Actual results may differ materially due to a variety of uncertainties and risk factors. Except as required by law, ARA assumes no obligation to update any such forward-looking statements.

.jpg)