Following the Growth in Skilled Labor

Supply of skilled labor has struggled to keep pace with demand, making it a compelling employment sector that may have downwind impacts for real estate investors.

Employment growth through 2025 has been generally lackluster, with tariff-related uncertainty and still-high interest rates weighing on demand for labor. One underappreciated bright spot continues to be in skilled trades, where supply has struggled to keep pace with demand, creating healthy wage growth that has supported community development. We believe this overlooked driver is a critical component to identifying the strongest potential areas to invest in real estate.

Shift Toward Skilled Labor

Most strategies over the last real estate cycle heavily skewed toward epicenters of white-collar job growth, and with good reason – industries like tech and finance were hiring at a rapid clip and at high starting salaries, positioning renters to be able to pay higher apartment rents and absorb rental increases more easily. While those industry engines are expected to continue to play a major role in the U.S. economy, an equally critical driver of employment stability is likely to be in blue-collar work, specifically skilled trades that are not easily replaced by AI and other technology agents.

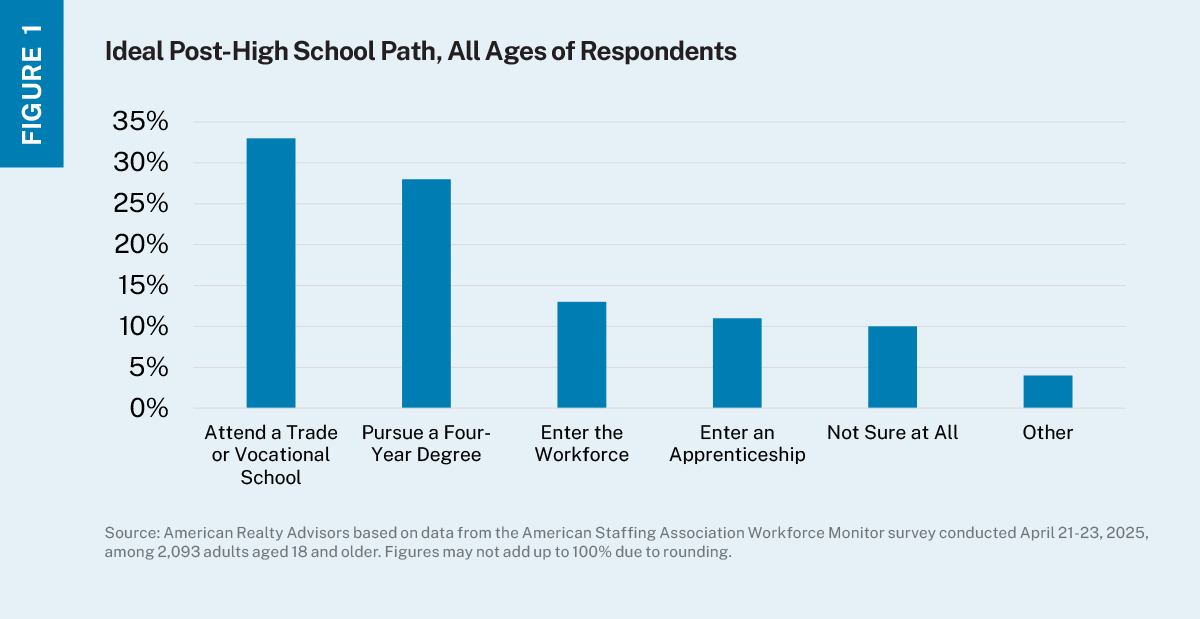

The awareness of skilled trades’ greater opportunity set is growing with today’s younger cohorts and the adults who help guide their post-high school paths. According to a study from the American Staffing Association, a greater share of adults is recommending vocational or trade schools as an ideal track, above the percentage of those in favor of directly enrolling in college (Figure 1).

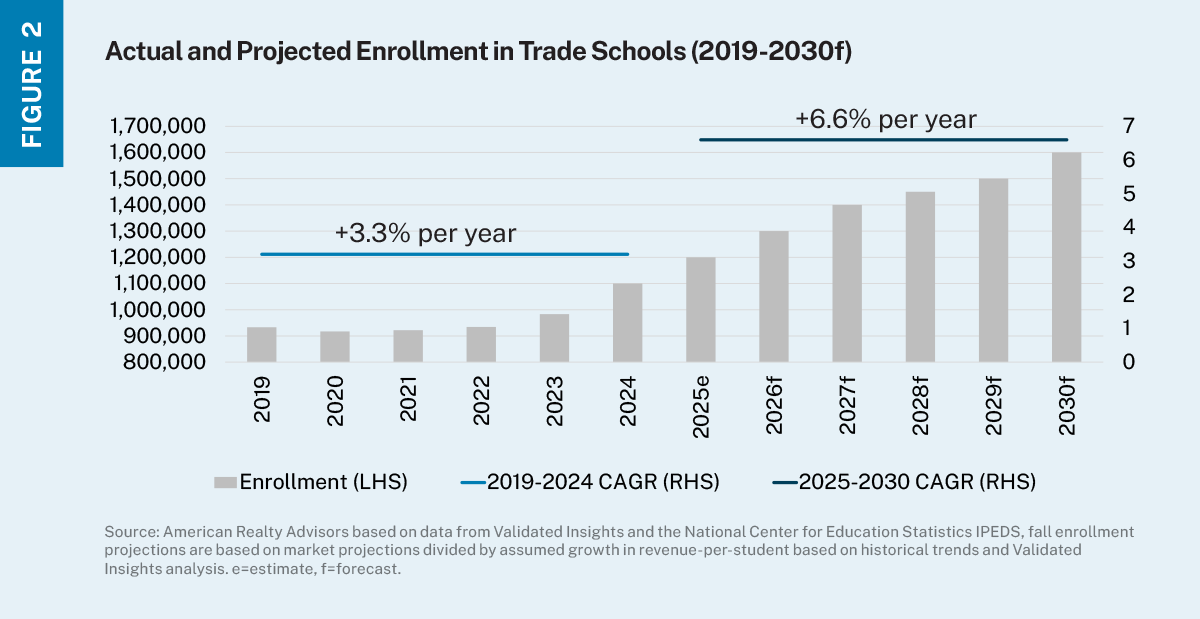

Young people are listening. Whereas trade school growth prior to the pandemic was largely stagnant, from 2019 to 2024 enrollment grew at a 3.2% compound annual rate and is expected to accelerate between now and 2030 (Figure 2).

From a practical standpoint, we continue to believe the rest of the year will reflect decent growth in real estate transaction volumes and ongoing improvement in fundamentals as the economy trudges along. Against this backdrop, our focus remains on cash-flowing assets with strategies underpinned by operational improvement paths versus those that may be purely “market recovery” bets.

Potential for Outsized Wage Growth

Earning prospects is a key factor in the appeal of pursuing skilled trades. Roughly 42% of Gen Zers (defined as those generally born between 1997 and 2012) are currently working in or pursuing blue-collar or skilled-labor jobs, citing the decision was driven by a desire to earn income sooner, avoid student loan debt, and a view that trade jobs offer better long-term prospects.1

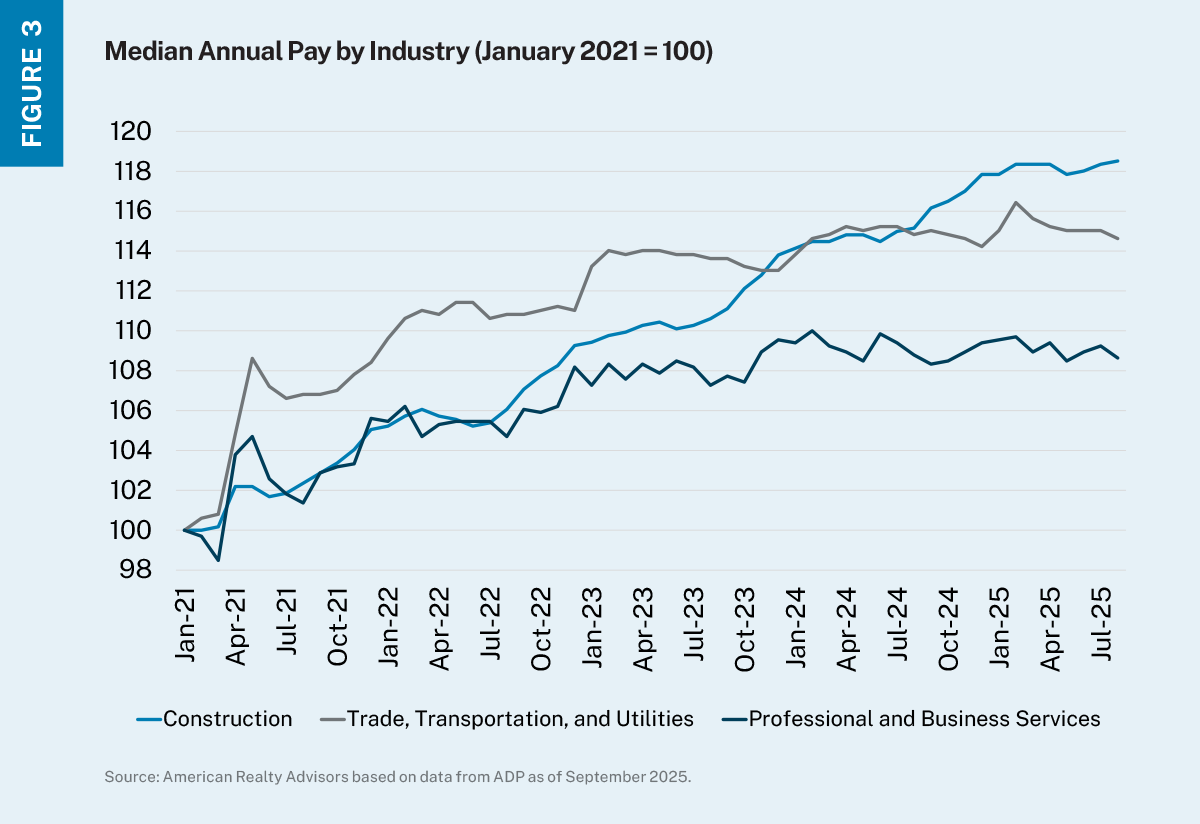

The proof is in the pudding. The median pay for new construction hires rose 4.4% to $70,400 year over year as of August 2025 (this, despite a general slowdown in development pipelines nationwide), virtually on par with starting salaries for new hires in professional services ($71,700) which grew at a slightly slower 4.2% year-over-year pace, according to data from ADP.

The pace of growth in the trades has been faster that of typical white-collar industries for several years given a favorable supply-demand imbalance for blue-collar workers (Figure 3). While this may normalize some as more workers choose the skilled trade route, there are a couple reasons why income growth in blue-collar industries may still outpace that of white collar:

- It is likely that retirements will be higher in blue-collar labor forces versus white collar, exacerbating labor needs relative to office-using employment; and

- A demand slowdown in the trades would likely correspond with a broader macro slowdown, which often disproportionately impacts more cyclical industries like finance compared to roles like plumbers, pipefitters, and teachers; in such a scenario, wages for the trades would still likely be more insulated from downside risks.

Implications for Real Estate Investing

Understanding and acknowledging there is a subtle but significant shift happening in the labor market offers insights into which markets may be better positioned to capture greater relative income growth in the coming cycle. This bodes well for residential strategies but also all types of commercial real estate – people earning more also typically spend more, which supports local businesses and demand for retail, industrial, and office space.

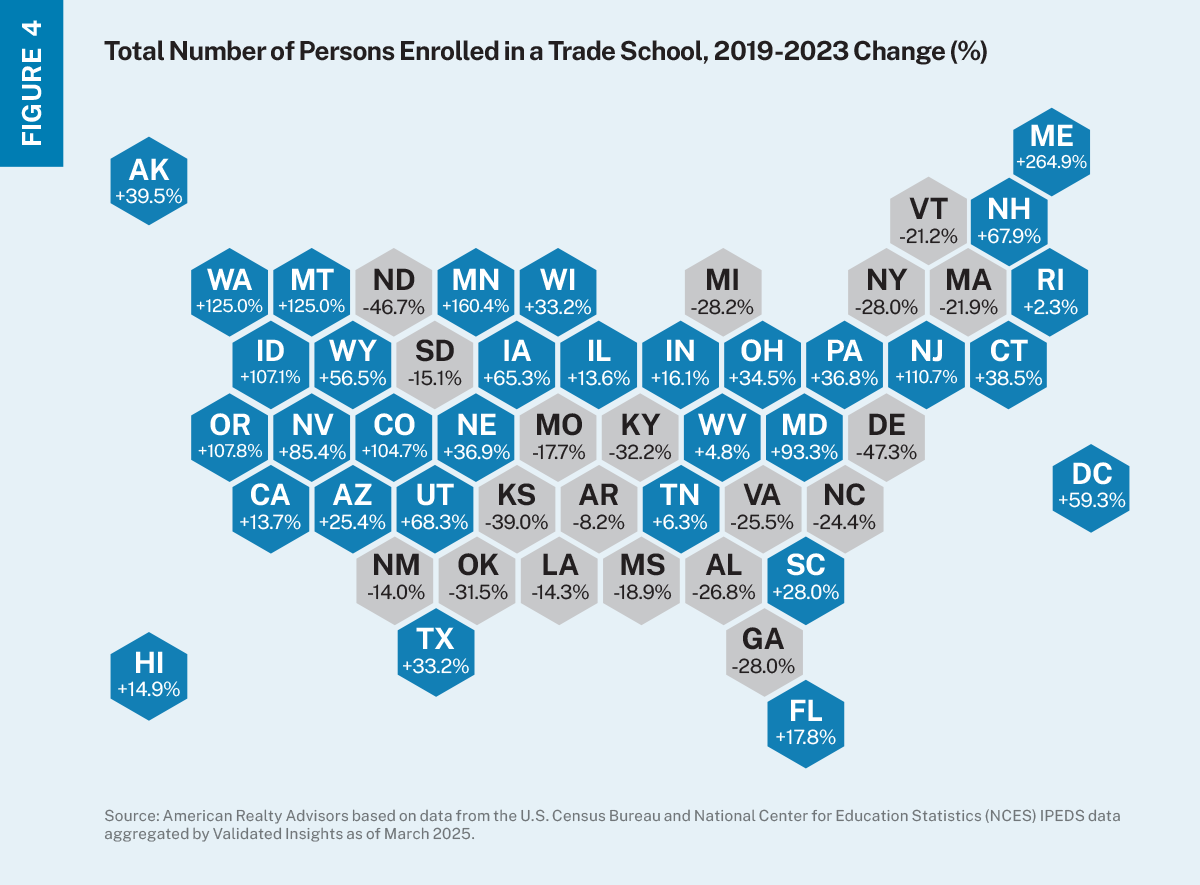

In practice, this comes down to targeting locations with an existing diversified economic base and a growing blue-collar labor force, given the demonstrated potential for outsized wage growth. A key indicator of where blue-collar workers may live is existing enrollment in trade schools. This has led us to target investments in states like Florida, Texas, Tennessee, and Arizona, where overall enrollment trends have been the strongest and the relatively lower cost of living may further entice trade school graduates to remain in the area (Figure 4). These states have also been the beneficiaries of growing white-collar labor forces for many of the same reasons.

Ultimately, we believe a strategy focused on investing in deep, diversified, resilient markets with a concentration of in-demand highly skilled blue-collar workers is likely to yield stronger relative rent growth and the potential for long-term value creation, two elements that are critical for investors’ portfolios.

Mid-Quarter Economic Pulse: Q3 2025