Research Insights, July 21, 2025

House View H2 2025

The real estate market seems to be recovering despite an economy that is still sending mixed signals. In our Midyear 2025 House View, we outline where we see opportunities for real estate investors amidst these shifting conditions.

---

The first six months of the year were marked by uncertainty, with a fluctuating tariff and policy backdrop influencing markets. Though these macroeconomic factors remain in flux heading into the back half of 2025, there does seem to be a growing acceptance that the way forward will likely look quite different than the order for much of the last 50 years, at least when it comes to trade.

Businesses have raised prices to account for higher costs, but demand has softened in lockstep, acting as a balance against a resumption of inflation. We believe the result is a slow-growth environment where demand-side dynamics take the lead in easing inflation and mitigate some near-term, tariff-related inflation concerns.

Real Estate Implications

We believe the near-term investment landscape will be anchored by a more modest growth backdrop, an environment in which stability may take greater precedence in strategy setting. Normally in the beginning phases of a new cycle, risk ultimately gets rewarded as fundamentals and capital markets “catch up” to early-mover conviction. However, with growth risks arguably skewed to the downside, there is a greater appetite for income resiliency, benefiting core assets and properties that can be repositioned to core using modest assumptions.

Fundamentals in many sectors have turned the corner, benefitting from a steep drop in new construction starts, but not all are improving at the same pace. We believe localized crosswinds may mask risk even in broadly improving markets; as such, bridging the gap between headlines and nuanced reality is central to where we see opportunities today.

Residential

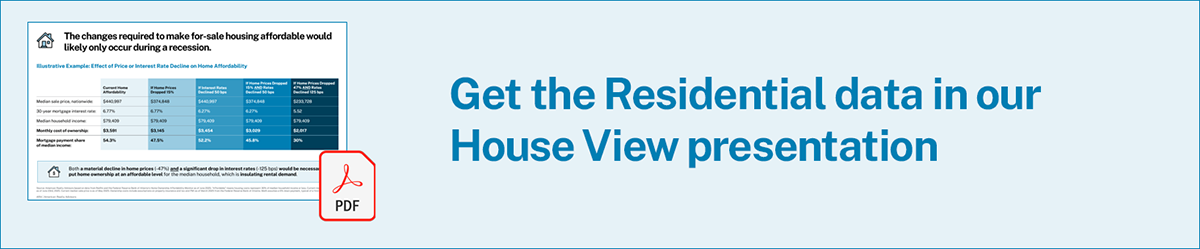

Headline: “For-sale market is quickly becoming a buyer’s market, putting rentals at risk of losing out to home ownership.”

Nuance: While it’s true the number of sellers has been outpacing buyers for several months, we are not in unprecedented territory (a similar average gap existing in 2014, too). The math to make home ownership accessible to the average family points to an extremely unlikely scenario where prices fall nearly 50% and interest rates drop 125 basis points.

Strategy: We continue to favor for-rent strategies, particularly assets that cater to where renters want to be (commutable suburbs) and what they’re able to afford (below top-of-market rents).

Industrial

Headline: “Tariffs have all but frozen industrial occupier decision-making as uncertainty lingers.”

Nuance: U.S. industrial users are not immune to uncertainty and supply chain changes that are likely to result from tariffs. However, demand for space has remained largely resilient despite these circumstances, and impacts are highly localized. Overall net absorption in the second quarter was essentially on par with the first quarter, and new leasing activity in H1 2025 totaled nearly 310 million square feet, modestly outpacing H1 2024.

Strategy: Some markets that are more vulnerable to global trade volatility today also have seen pipelines dry up, which may help mute some of the impact. Lease decisions may be delayed in the short term, but it may lead to pent-up demand being unleashed once trade uncertainty eases, benefitting groups that are overweight industrial.

Retail

Headline: “Investors are moving back into retail given how strongly the sector has performed the last few years.”

Nuance: The retail sector did indeed outperform in the last few years, though this has as much to do with higher starting cap rates not needing as large a pricing reset as it does to the strength of fundamentals. In fact, from recent highs in 2022, rent growth and net absorption across the various subsectors have been moderating back to normal ranges.

Strategy: We continue to believe that well-located, well-leased, grocery-anchored retail has a role to play in investors’ portfolios; we view the current environment as a prime window to harvest profits on certain investments given elevated investor interest and the potential for further softening in fundamentals.

Office

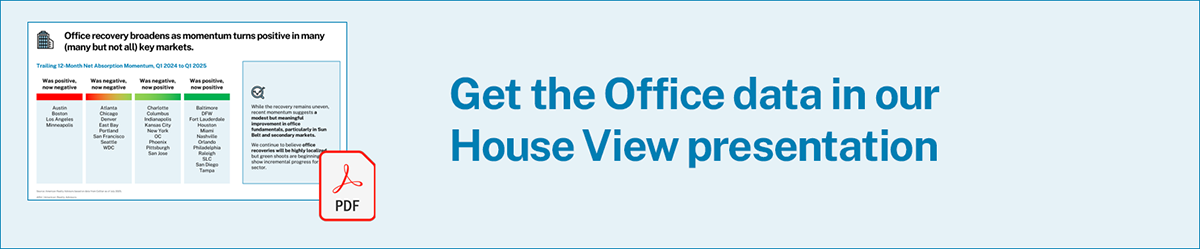

Headline: “The U.S. office market is showing signs of recovery, with leasing volumes approaching pre-pandemic levels.”

Nuance: Recoveries are starting to take root in certain markets, though the signs are early and the pace generally measured. National statistics insinuate a full-swing recovery, however for every market where net absorption is positive, there is a nearly equal number that has slipped backwards or stayed negative.

Strategy: Incremental progress in office is better than no progress; however, we believe that the recovery will be protracted given our view of a slower economic growth path, particularly in select primary markets that have yet to “turn the corner” on fundamentals and intend to maintain our underweight to the sector.

Specialty Sectors

Headline: “Investors should focus on increasing their allocations to specialty sectors.”

Nuance: Specialty sectors are not created equal. While some do seem to offer above-average returns and compelling supply-demand dynamics (like data centers), others, like student housing, may have less-resilient demand drivers and a more tepid outlook.

Strategy: In some segments, the “specialty” comes from a highly specialized expertise required to operate these properties that also comes with a hefty price tag (like some sub-types of senior housing). We favor some specialty sectors that are driven by demographics but are thoughtful about those with expensive learning curves and underappreciated risks.

Print Charts and Figures PDF

---

More to Explore:

---

Disclaimer

The information in this newsletter is as of July 21, 2025, and is for your informational and educational purposes only, is not intended to be relied on to make any investment decisions, and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This newsletter expresses the views of the author as of the date indicated and such views are subject to change without notice. The information in this newsletter has been obtained or derived from sources believed by ARA to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based. Models used in any analysis may be proprietary, making the results difficult for any third party to reproduce. Past performance of any kind referenced in the information above in connection with any particular strategy should not be taken as an indicator of future results of such strategies. It is important to understand that investments of the type referenced in the information above pose the potential for loss of capital over any time period. This newsletter is proprietary to ARA and may not be copied, reproduced, republished, or posted in whole or in part, in any form and may not be circulated or redelivered to any person without the prior written consent of ARA.

Forward-Looking Statements

This newsletter contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are statements that do not represent historical facts and are based on our beliefs, assumptions made by us, and information currently available to us. Forward-looking statements in this newsletter are based on our current expectations as of the date of this newsletter, which could change or not materialize as expected. Actual results may differ materially due to a variety of uncertainties and risk factors. Except as required by law, ARA assumes no obligation to update any such forward-looking statements.

.png)