Research Insights, January 12, 2022

A Note from Our Head of Research: 2022 Inflation Outlook

As we close the books on 2021, I got to reflecting on our predictions for the coming year. Inevitably, this led me to

revisit our take on the outlook for inflation, and whether it might need to be adjusted in the wake of recent data. Particularly with the Fed coming out of their December meeting denoting an expectation of three rate hikes in 2022 and as many as seven between now and 2024, our expectations now seem particularly dovish.

Even so, I’m not quite ready to fully pivot our position. After all, it seems highly likely that one or more of the following materializing in the coming six to seven months – a supply catch-up, a natural moderation in demand or even one Fed rate hike – would serve to slow the pace of inflation in the latter half of 2022 (as, I might add, we’d originally forecast), perhaps reducing the need for further hikes, at least in the near term.

What Would Prevent Multiple Rate Hikes?

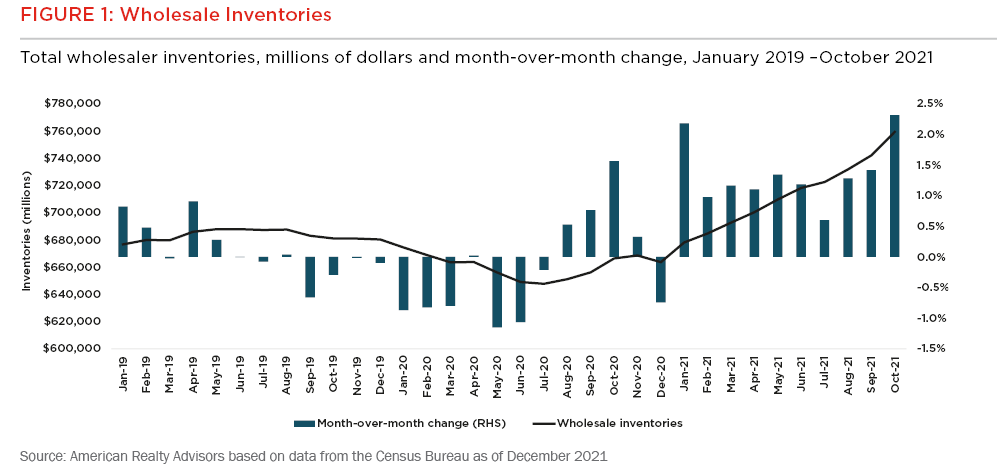

If you encountered any out-of-stock notifications during your holiday shopping, it may be hard to believe, but there is evidence that companies’ efforts to shore up their supply actually led to an inventory buildup. While this may sound good in theory (given the inflation we’re experiencing is the result of too many dollars clamoring for too few available goods), an elevated stock combined with moderating demand could spell trouble if retailers are forced to make meaningful discounts in order to move excess. Just think of all those Halloween and Christmas decorations sitting in containers off the coast of Southern California that will either need to be discounted heavily or stored until next year.

Avoiding a Policy Mistake

While the Fed can’t directly do much to increase manufacturing productivity or clear shipping lanes to help solve the supply side of the equation, raising rates to cool the consumer part of the demand picture that is fueling strong inflation is a tool in their arsenal. The risk now is whether they may do so at the same time when that much coolant is no longer needed, creating frigid economic conditions.

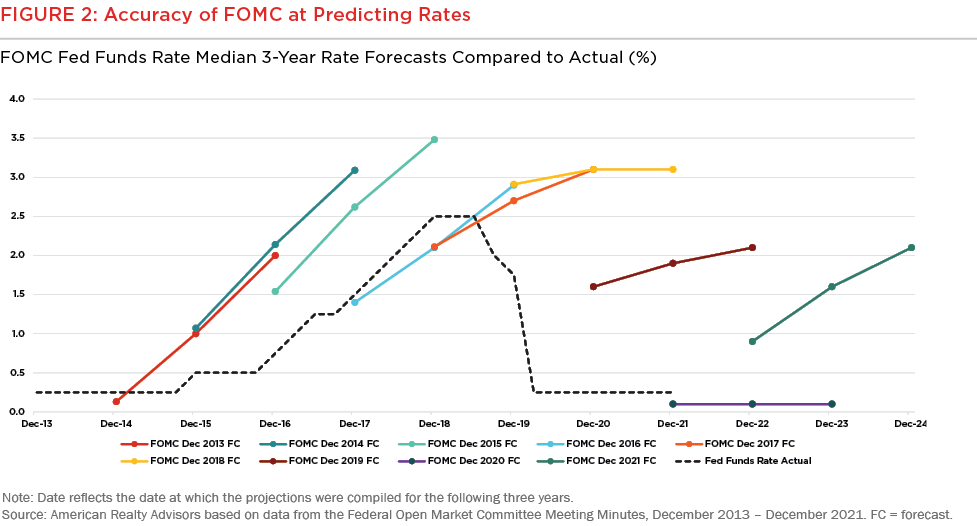

But there is reason to believe that, despite the Fed signaling a multi-hike 2022 agenda, they may avoid this particular policy mistake. And that reason is simply that the Fed has not been all that great at projecting their own Fed Funds Rate (FFR) trajectory.

This seems to go against basic logic, but it’s true – over the last eight years, the Fed has been meaningfully more hawkish in its expectations of the future FFR than what has occurred. That’s not to say that “this time won’t be different,” simply that if I were a betting (wo)man, I wouldn’t place a big bet purely based on where the dot plot says rates will be at the end of the next few years.

Final Thoughts

The inflation equation today is complex, and there are several ways it could play out in the coming months depending on the path of the virus and how consumers and companies respond to it. And of course, adding to anxieties is the prospect of rate hikes.

It’s in times like these where maintaining a long-term perspective is critical for real estate investing. Yes, we don’t want to be caught unprepared for a steep hike cycle that could affect the relative value of yields from our asset class; but a gradual normalization of policy on the margins of zero alone shouldn’t drive meaningful changes in sector, market, or asset selection strategy. In peak uncertainty, sometimes it’s better to stay the course than to overreact.

We head into 2022 believing the path towards normal (whatever that might look like in a post-COVID or concurrent-COVID world) could be bumpy; we’re grateful for the opportunity to navigate it together with you.

Disclaimer

The information in this newsletter is as of January 6, 2022 and is for your informational and educational purposes only, is not intended to be relied on to make any investment decisions, and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This newsletter expresses the views of the author as of the date indicated and such views are subject to change without notice. The information in this newsletter has been obtained or derived from sources believed by American Realty Advisors, LLC (“ARA”) to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based. Models used in any analysis may be proprietary, making the results difficult for any third party to reproduce. Past performance of any kind referenced in the information above in connection with any particular strategy should not be taken as an indicator of future results of such strategies. It is important to understand that investments of the type referenced in the information above pose the potential for loss of capital over any time period. This newsletter is proprietary to ARA and may not be copied, reproduced, republished, or posted in whole or in part, in any form and may not be circulated or redelivered to any person without the prior written consent of ARA. Photos used in this presentation were selected based on visual appearance, are used for illustrative purposes only, are not necessarily reflective of all the investments made by ARA or which ARA may make in the future.

Forward-Looking Statements

This newsletter contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are statements that do not represent historical facts and are based on our beliefs, assumptions made by us, and information currently available to us. Forward-looking statements in this newsletter are based on our current expectations as of the date of this newsletter, which could change or not materialize as expected. Actual results may differ materially due to a variety of uncertainties and risk factors. Except as required by law, ARA assumes no obligation to update any such forward-looking statements.