Tracking Progress in the New Real Estate Cycle

In the Spring of 2024, ARA Research published a short piece entitled When Tough Times Offer Good Timing. The article outlined the green shoots we saw emerging in property markets signaling what we believed would be the turning point towards the beginning of a new cycle.

Eighteen months later, we look back on those early indicators to see how things have progressed, and outline why we believe now is the right time to invest in private real estate.

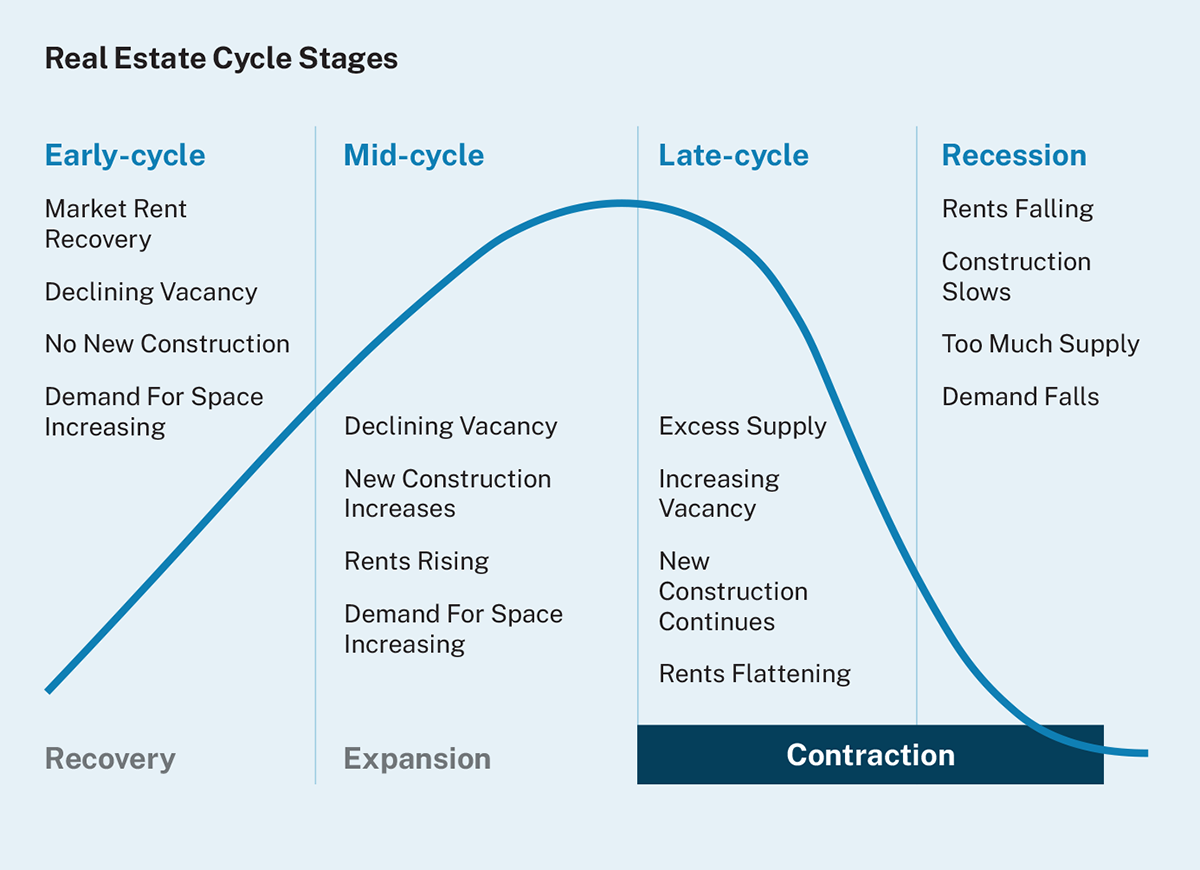

Then: Cycle fundamentals looked to be bottoming.

Source: When Tough Times Offer Good Timing

Now: Fundamentals in most sectors are firmly in the “Early Cycle” phase.

- Development pipelines have thinned; apartment and industrial development pipelines are down over 50% from peak (53.2% and 52.2%, respectively).[1]

- Rents are stabilizing and beginning to find their footing.

- Fundamental improvements are supporting the turnaround in market confidence and returns.

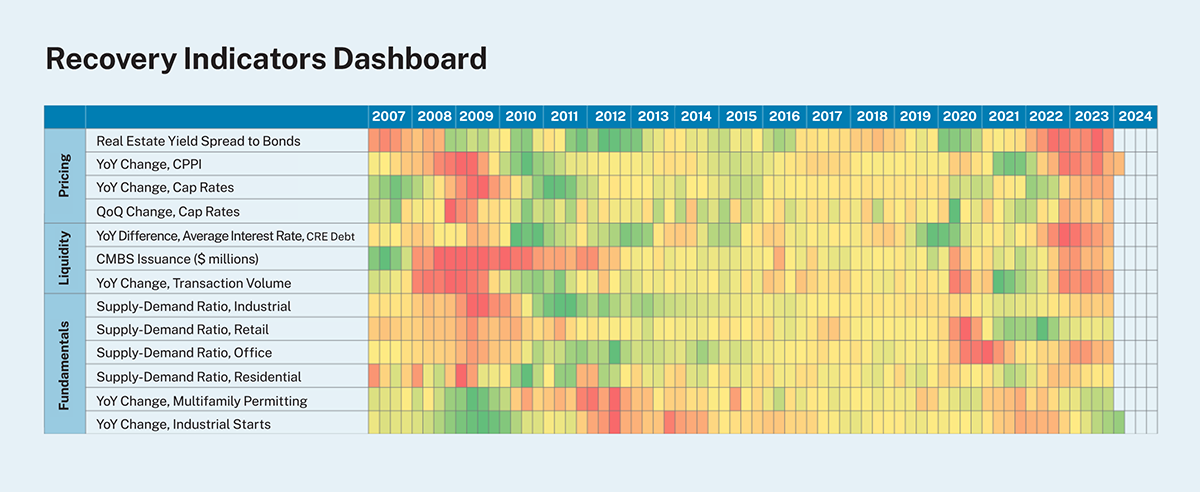

Then: Liquidity and pricing measures were still constrained.

Source: When Tough Times Offer Good Timing

Now: Liquidity has returned and pricing is normalizing.

- Transaction volumes have increased year over year for six consecutive quarters.

- Year-to-date volume through September ($352.9 billion) is the highest same nine-month period since 2022.

- Nearly all recovery metrics have moved to normal territory; only bond spreads remain outside normal bounds.

- CMBS issuance is healthy, and bank lending has become less restrictive, supporting further improvement in performance.

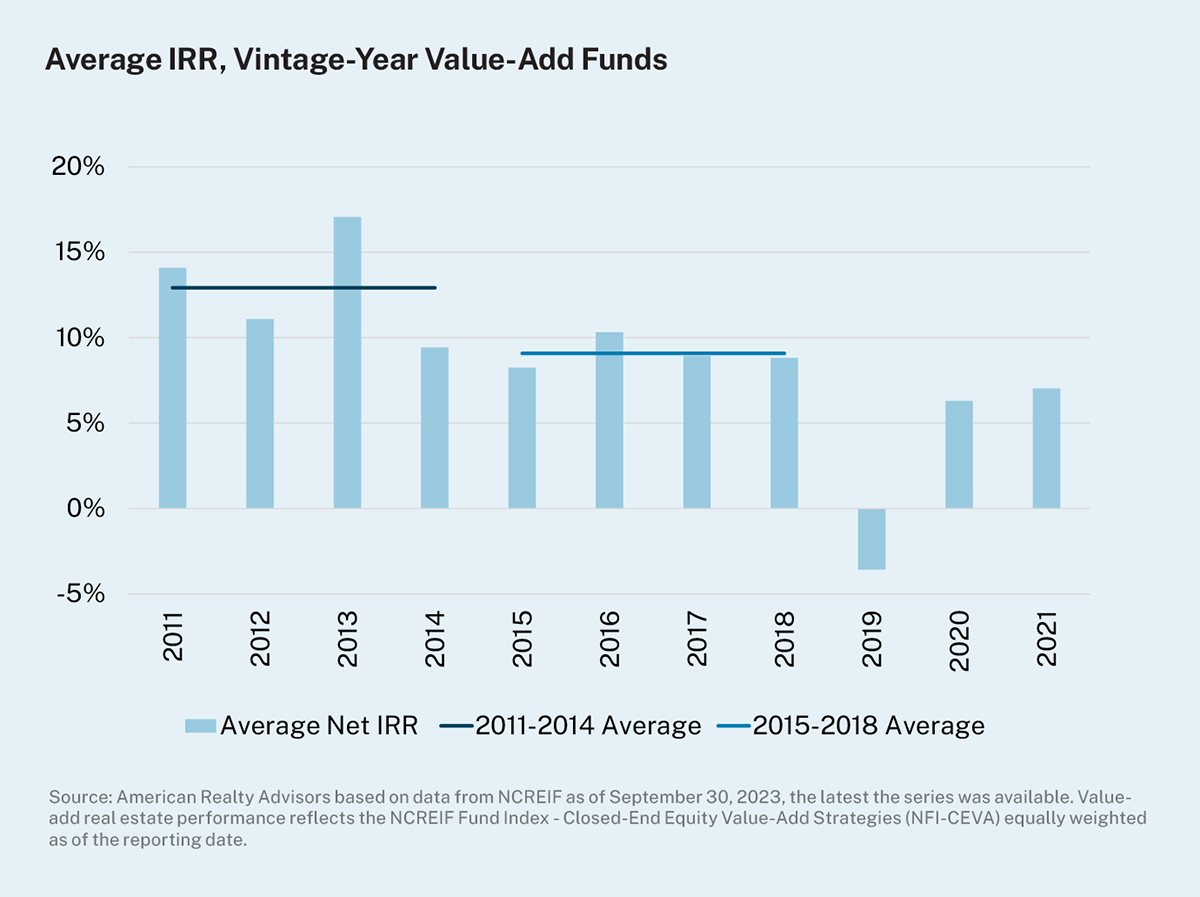

Then: Investing earlier in recoveries has been better than waiting.

Source: When Tough Times Offer Good Timing

Now: Returns have been positive for five consecutive quarters.

- Returns turned positive in Q3 2024 after seven negative quarters.[2]

- Unlevered returns through Q3 2025 confirm we are firmly in the early-cycle investment window.[3]

- Values remain down ~19% from recent peak, offering compelling entry discounts.[4]

- Investors may benefit from expected recovery upside by acting now.

What should investors focus on in commercial real estate for 2026?

With many hallmarks of recovery now firmly emerging, the early stages of this cycle are offering promising conditions for proactive investors. As we approach 2026, those considering entry may benefit from attractive pricing, gradually improving fundamentals, and a supportive capital environment. While each cycle unfolds differently, current trends suggest that early action could position investors well for the next phase of growth.

Our H1 2026 House View, scheduled for release in mid-January, will explore the crosscurrents and tailwinds affecting real estate for the period ahead. Stay tuned.

House View H1 2026