Mid-Quarter Economic Pulse: Q4 2025

The Fed faces a December rate cut decision that may hinge on incomplete data due to delays from the government shutdown.

The first day of the fourth quarter started with the U.S government entering a shutdown, impacting many critical agencies and prompting widespread employee furloughs that persisted for a record 43 days. One of the casualties of the shutdown was the delay in the latest jobs and inflation numbers, critical barometers for the Fed as it contemplates its most appropriate policy path, making its mandate even more complicated with lagged and imperfect visibility.

Heading into the shutdown, the latest official inflation figures through September stood at 3%, up modestly from the 2.9% year-over-year measure in August but below consensus expectations. Directionally, an uptick might prompt a more cautious Fed approach to further easing, were it not for some of the signals coming out of the labor market.

But that too may prove a hazy data point, with a looming possibility that October jobs and inflation data may not be released at all. As a result, Fed officials may have less data on hand than usual to help inform their December rate decision at a critical period where economic growth (measuring at a running seasonally adjusted annualized rate of 4% at last measure by the Atlanta Fed GDPNow)1 appears strong but general labor and consumer conditions feel softer.

Implications for Real Estate

The ensuing data “blackout” from the shutdown threatened to add unwelcome uncertainty for real estate investors, though momentum has thus far held up in most corners of the industry. Improving fundamentals in a growing number of market-sector combinations and a healthy-enough unemployment and economic backdrop is keeping the real estate recovery on track. While there was a bit of cooling on the issuance of new asset- and mortgage-backed securities in the week through November 14 compared to the prior week (with issuers working to price 19 offerings totaling $9.1 billion versus 33 deals of aggregate $18.1 billion completed through November 7)2, investor demand remains healthy on the debt side, which has bolstered equity liquidity conditions and facilitated transactions.

We might expect to see volatility increase some come December in the event the Fed decides to leave rates unchanged, though already markets have had to walk back what had at one point been a 95% probability of another cut this year. As of November 14, the probability of a December cut had been reduced to essentially a coin flip (46% for, 54% hold).3

A “no-cut” December would not necessarily derail the gradual value recovery underway in private real estate if the reason for the hold is a matter of data visibility. If the commentary is more dovish (cuts still coming soon, but policymakers simply need more data), yields on the long end of the curve, which are typical benchmarks against which real estate cap rates are compared, may stay flat. Various Federal Reserve policymakers have noted in recent days that they do not see a meaningful enough deterioration in the labor market to warrant premature cuts; so while lower rates could mean cheaper financing, a hold may actually signal that demand is more resilient than originally thought in the third quarter, which again is generally positive for tenant demand.

Overall, the same forces that may delay the next rate cut are also those that are keeping the economy, and by extension the real estate market, in a stable enough position to maintain cautious optimism.

Filling the Data Gaps

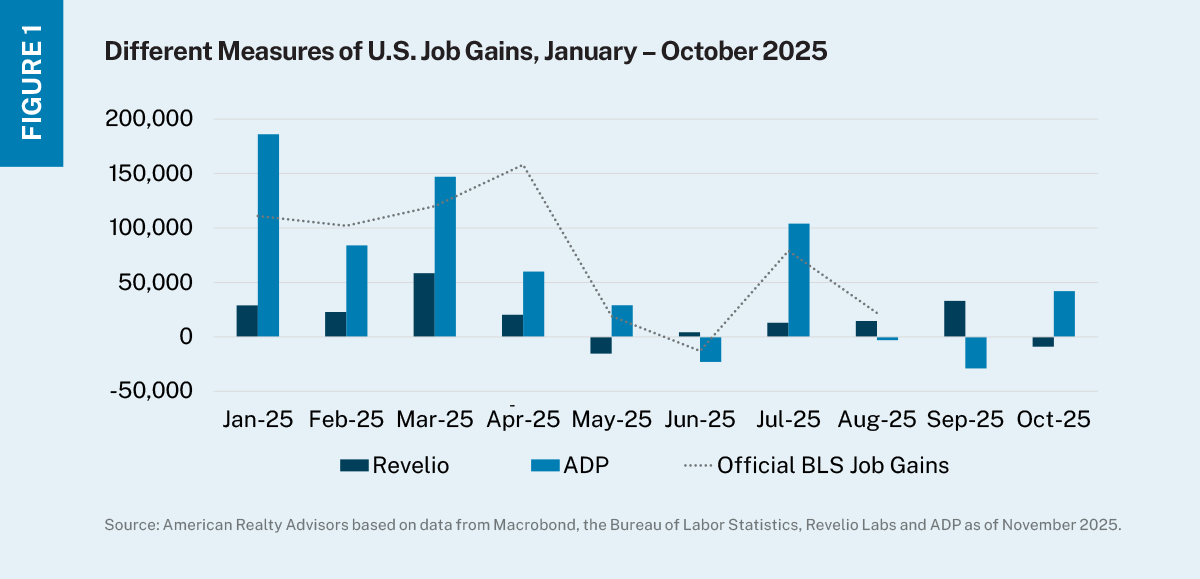

Without official labor and inflation data for October, economists, businesses, and markets at large have been left to piecemeal together a snapshot of the economy from alternative sources. One such example is the ADP National Employment report as a stand-in for the Bureau of Labor Statistics, where the private sector added 42,000 jobs in October, bucking the two-month trend of contractions in both August and September and offering a generally optimistic view of the job market.

But not all privately produced data is telling a similar story. Revelio Labs Employment Report, which bases its data off 100+ million U.S. profiles covering two-thirds of all employed individuals (versus an estimated 27% from the BLS establishment survey), showed 9,100 jobs were lost in October, a decidedly different signal than the ADP number (Figure 1).

Determining which of these is a more accurate measure of the current state of the labor market is helped by considering recent layoff announcements. Including the roughly 307,000 jobs shed in the government sector, layoffs nationwide year to date through October have totaled 1.1 million, with more than 150,000 occurring in the last month alone. This represents the highest 10-month period for layoffs since the onset of the pandemic, yet initial jobless claims have been little changed in recent weeks and have been fairly range bound through much of the year. So while there is some softness happening, conditions don’t appear to be deteriorating significantly in the aggregate.

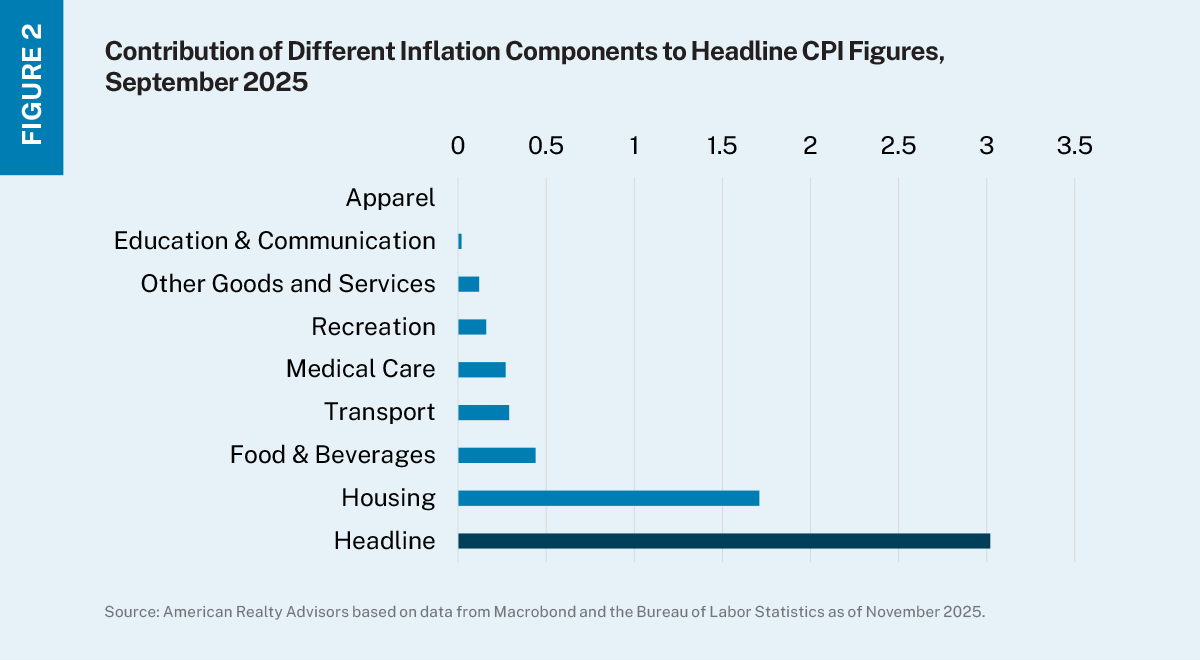

The other question when it comes to Fed policy moves then is the likely path of inflation. As noted, inflation did increase month-over-month between August and September, though less than expected. Whether or not there is further upward pressure yet to come from tariffs is at the forefront of policymakers’ minds, and yet so far, the greatest contributor to the latest official read was not from imported goods, but from housing.

Of the different categories of goods and services in the CPI basket, housing’s contributions to the September reading were 1.71 percentage points, (Figure 2). For anyone who owns or operates residential real estate, this stands counter to reality in the housing market given below-average home sales and only modest rental growth in many markets.

This is, of course, not the first time the housing component of inflation has lagged real-time indicators, and there has been much written about the flaws in the CPI measurement of housing costs. The takeaway is that, even though headline inflation remained a full percentage point above the Fed’s 2% target in September, much of that appears to be the result of stale housing data. We continue to believe the case for another rate cut will eventually prove more credible than the case to hold.

Where we stand at the midpoint of the fourth quarter is that economic data is not decidedly strong or weak. This “mixed-bag” economy is creating a bifurcated reality, where unemployment remains low and GDP growth high while at the same time layoffs are on the rise. For real estate, this likely means the strike zone is more a bullseye than a barn door when it comes to market and asset selection, as different segments of the economy are likely to have very different growth trajectories.

House View H1 2026