Mid-Quarter Economic Pulse: Q3 2025

Third-quarter data has thus far offered reasons for both caution and confidence, with the next interest rate move hinging on how the Fed interprets the economy’s mixed signals.

The initial weeks of the third quarter seemingly progressed with little fanfare. White House moves related to ongoing tariff negotiations were encouraging and generally benign. Equity markets recorded new highs, more than recovering from their tariff-induced April meltdowns. By many accounts, the economy was holding up about as well as could be expected, enough to prompt a modest improvement in consumer sentiment in both June and July.

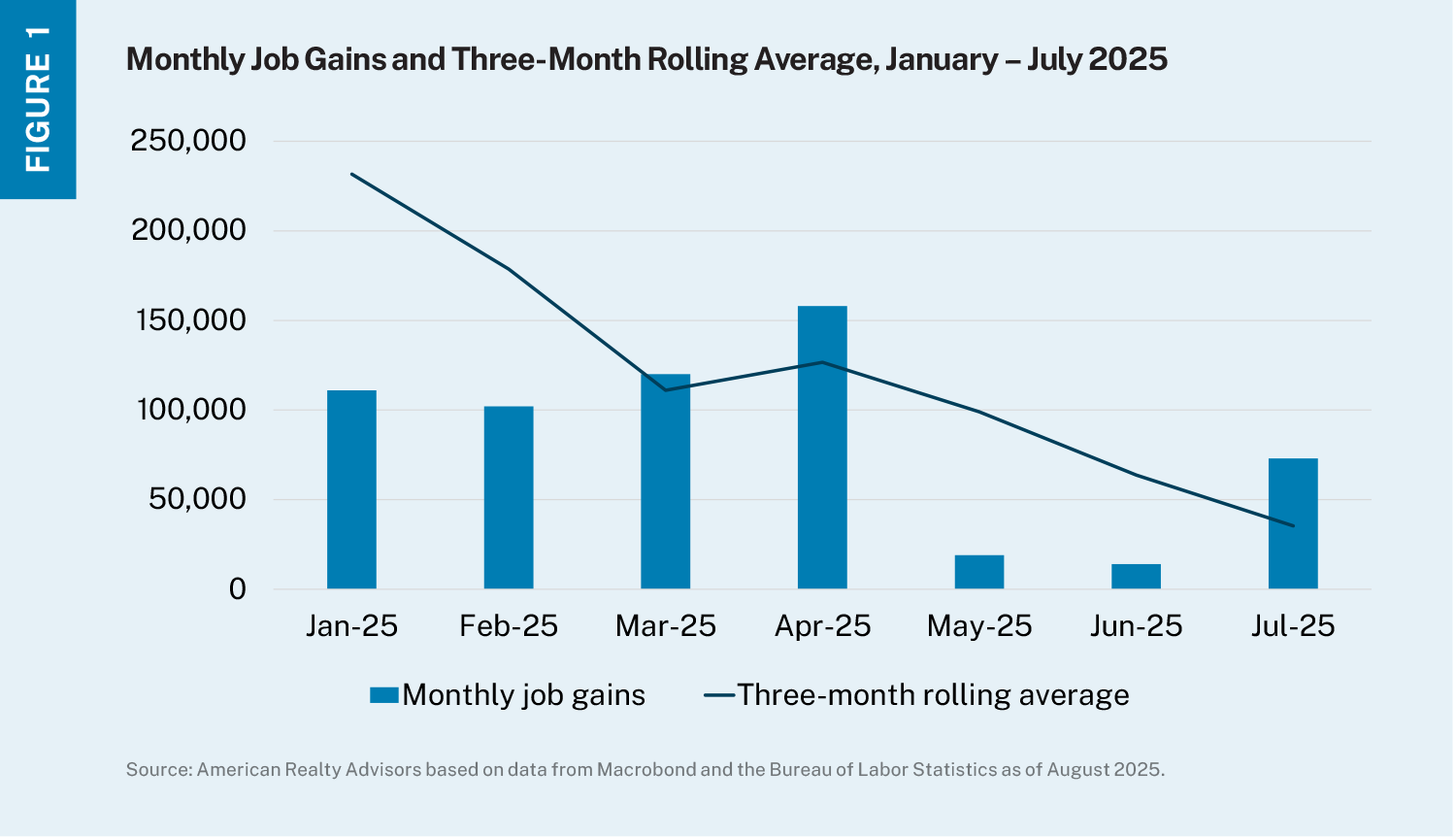

That brief respite from headline fatigue came to a halt the first week of August, when July employment data was released. The lower-than-expected 73,000 jobs, combined with downward revisions to both May and June’s gains, put the three-month job growth numbers at the lowest level since 2010 (not including the peak pandemic months). Where before the health of the economy might have been shrouded by tariff noise, the picture of the slowdown has come more into focus as the quarter has progressed.

As we had anticipated, the growth side of the equation appears to be requiring Fed attention first. While inflation accelerating amidst tariff implementation is a key risk, weaker domestic demand may temper some of the immediate surge. Anticipated policy rate cuts should help stabilize the domestic economy and avoid a further down step in growth momentum, but we fully expect slower growth to continue to serve as the backdrop for a gradual real estate recovery.

Implications for Real Estate

The budding real estate recovery has continued to slowly gain traction through Q3. Normally going out on the risk spectrum early can ultimately be rewarded as fundamentals and capital markets “catch up” to early-mover conviction, but in the current environment, an emphasis on stability may take greater precedence in strategy setting at least in the immediate term.

Part of the reason for this is the apparent moderation in jobs growth. With July numbers coming in well below consensus expectations and the downward revisions in both May and June data, assets with sturdy in-place cash flows or clear paths toward enhanced net operating income growth continue to be favored by investors who do not want to take on undue risk at a time when economic growth may be moving through a downshift. Recent data from MSCI seems to reflect this hesitancy, with June transaction volume down 16% year over year.[1]

We can see this subtle shift in orientation in the broader markets, too. Corporate credit spreads (which measures the premium investors require from corporate bonds in interest over government bonds) dropped to within one basis point of their 1998 lows on July 29, a sign that investors are taking a more cautious approach to corporate credit.[2]

From a practical standpoint, we continue to believe the rest of the year will reflect decent growth in real estate transaction volumes and ongoing improvement in fundamentals as the economy trudges along. Against this backdrop, our focus remains on cash-flowing assets with strategies underpinned by operational improvement paths versus those that may be purely “market recovery” bets.

A Deeper Look at GDP

The July jobs number (combined with previous months’ revisions) paints a picture of a decelerating domestic labor market (Figure 1).

On the surface, overall unemployment remains low (4.2%), and has shown little change from April, suggesting a labor market that is holding at relative equilibrium. Layoff rates have stabilized after a gradual increase in recent years, and less foreign-born labor supply may be limiting hiring potential in a low-firing environment.

Yet there are also soft spots. One of these is where the jobs are (and are not) coming from. Absent healthcare and social assistance jobs, job growth over the last three months would have been negative, indicating a more concentrated source of total employment gains. While we do not think demand in this sector is likely to slow in the near term given demographic trends, this suggests other areas of the economy, including some white-collar industries, are contracting, making for a narrower path for overall job growth going forward.

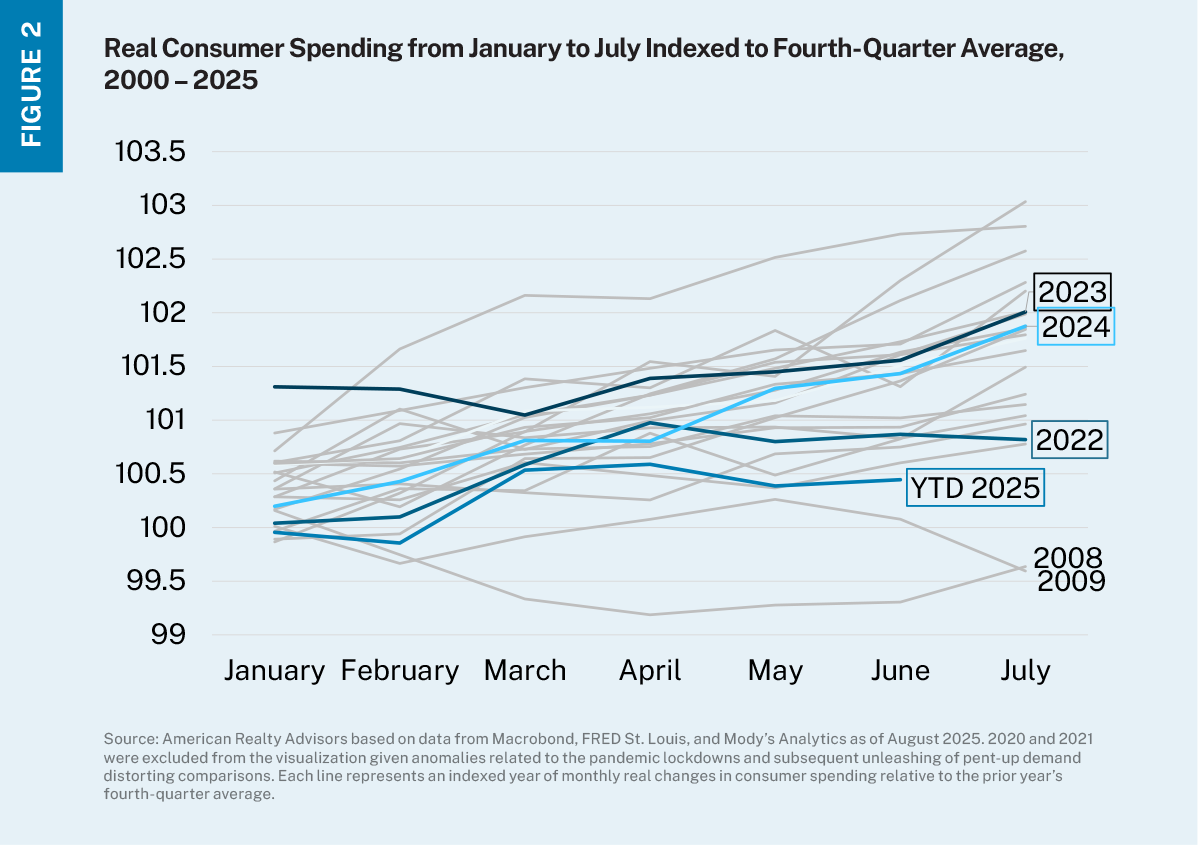

This has been impacting overall consumer activity—recent data suggests the top 10% of households now represent nearly half of all consumer spending.[3] Relative to the average seen in Q4 2024, the change in inflation-adjusted monthly spending through the first six months of 2025 is tracking well below recent years (Figure 2).

We believe the economy can avoid recession; initial unemployment claims have dropped, suggesting that, while employers may not be creating new jobs, they aren’t letting go of the employees they have. This, combined with less-available labor from fewer immigrant workers, should help keep unemployment range bound. So long as firms continue to absorb tariff impacts through margin compression, inflation is likely to remain above 2% but not accelerate so quickly that the Fed is required to respond to that over the labor slowdown. But the pace of change has accelerated, and there are several paths the economy and interest rates could take from here.

The recent recalibration in real estate pricing and fundamentals means real estate entered this period already having absorbed a substantial reset in values and thus is relatively better positioned to respond to more modest economic growth. We believe the ongoing rebound will unfold more gradually, which may work in investors’ favor, extending the opportunity window to re-enter the market at a healthy basis that should serve investors well for the remainder of the new cycle.

Following the Growth in Skilled Labor