Research Insights, January 22, 2021

Look Back, Look Forward - ARA's 2021 CRE Outlook

Executive Summary

- Marked by the onset of the worst pandemic in a century, U.S. GDP plunged into a contraction that, even after a strong slingshot rebound in Q3, is likely to have left the economy ~3.2% lower than year-end 2019 once full-year figures are confirmed.

- However, Democratic control of both houses of Congress should result in further stimulus measures being enacted in H1 2021, contributing to ARA’s GDP outlook of +3.6%-4.4% this year.

- The already-forming “K-shaped” bifurcation between stronger and weaker asset classes and markets was further intensified by the impacts of COVID-19, a trend that is expected to continue in 2021.

- Given ongoing challenges in certain segments of the retail sector and lingering uncertainty related to WFH permanence, industrial and multifamily continue to offer the most compelling fundamentals and capital markets backdrop.

- Investment activity is poised to reaccelerate, creating the potential for further appreciation in secularly supported sectors.

There is no denying that 2020 was one for the history books. In our commentary a year ago, we, like many others, did not anticipate the pandemic and resulting global economic impact that ensued. However, this crisis, like many before it, has served as an accelerant for change. Trends that were already in the making have only been hastened and in that respect, much of our prior “Look Back, Look Forward” remains relevant.

At that time, we suggested that the period of widespread cap rate compression was largely behind us and that income would become the focal point for private real estate investors going forward. Despite the unanticipated shock, this has thus far borne out, with incomes holding up all property sector total returns year to date through Q3 2020 and cap rate trajectories largely stable.

2020 Year in Review and Outlook for 2021

GDP forecasts conducted prior to the pandemic now appear quaint as the nation was brought to a standstill amidst country-wide shutdowns, plunging the economy into a projected 3.2% contraction for the year. Though we witnessed a remarkable rebound in Q3, the subsequent pace of recovery has begun to slow. Future economic growth is most certainly dependent on the speed of vaccine distribution and further stimulus to support the economy. Though another round of stimulus was approved in mid-December, the anticipated impact is expected to be more muted, with only $600 payments approved. However, with the marginal Democratic lead within the House and Senate, coupled with a Democratic administration, expectations have resumed for additional stimulus measures to occur in the first half of 2021, providing further relief to households through possible direct payments and expanded unemployment benefits.

“We did not anticipate the pandemic and resulting global economic impact that ensued. However, this crisis, like many before it, has served as an accelerant for change.”

Although we believe economic prospects in 2021 will look rosy by comparison, growth will hinge upon how effective fiscal and monetary policy are at staving off longer-term issues in the labor market. As economic damage lingers, the number of people shifting into long-term unemployment raises concerns about permanent scarring. Nevertheless, vaccine-related optimism, coupled with a new White House administration may provide the jolt needed for a strong growth year.

Furthermore, with the Federal Reserve signaling an accommodative “even-lower-for-even-longer” policy for several more years, interest rates are expected to remain low throughout the recovery. That said, long-term rates, which are more heavily influenced by market forces, are expected to rise moderately as both inflation and growth expectations rise. This has historically made buying real estate cheaper on a relative basis, as cap rates typically expand to maintain the spread over risk-free Treasuries. This may be offset somewhat by the significant amount of dry powder awaiting deployment into real assets, and we expect cap rates to remain near their current levels, particularly for the most sought-after property types.

Within markets and property sectors, we are seeing a bifurcation between the winners and losers. Headlines of a failing retail industry are more nuanced once closely examined, as shifting spending patterns have favored necessity retailers in the face of countless mass-retailer bankruptcy announcements. Despite a recent slowdown, consumer spending has been the engine of the recovery thus far. Expectations for 2021 reflect the economy making a strong rebound as consumers celebrate the arrival of the vaccine with pent-up demand spending, catapulting GDP expectations to between 3.6-4.4% for the year, though the spending boost may not fully materialize until the second half of the year (given distribution timelines and winter weather-related headwinds).

"As consumers celebrate the arrival of the vaccine with pent-up demand spending, catapulting GDP expectations to between 3.6-4.4% for the year.”

Additionally, the urban-versus-suburban debate has dominated headlines as people have foregone densely populated areas in exchange for greater space in the suburbs. While there indeed exist segments of urban weakness, pockets of strength can also be found throughout industries, property sectors, and markets. While ongoing uncertainty may keep some buyers on the sidelines, with vaccine progress restoring confidence and pressure mounting to deploy dry powder, we expect to see higher transaction volumes in 2021.

Property Sector Outlook

Residential

While residential fared better than other sectors due to the necessity of housing, rent growth received a one-two punch in 2020 due both to the coronavirus as well as an uptick in deliveries seen in major cities nationwide. In fact, deliveries across 50 major markets increased by 51% in 2020 compared to 2019. 2021 should see a decrease in deliveries for most cities, resulting in an earlier rent growth recovery for those markets with a lighter pipeline. Heavy supply pipelines, coupled with urban flight in densely populated cities, have left urban markets substantially impacted, with pains expected to linger in 2021. While a vaccine provides long-awaited relief, urban leasing outlooks remain soft for the coming year as mass vaccine distribution is likely not achievable until mid-to-late spring, resulting in continued urban hesitancy during peak leasing (Q2 and Q3 2021). Conversely, secondary markets, which characteristically remain cheaper due to elevated supply competition, have benefited from urban flight, and rode out the pandemic in a stronger condition than their larger, more metropolitan counterparts. However, this is not to proclaim the decline of gateway cities – in fact, we expect large urban cores to ultimately have a bigger rent growth pop in 2022 and beyond.

While residential rent collections have held up relatively well throughout the pandemic, the pattern suggests there is an increasing chasm between Class A and B renter households and lower-income Class C. Since the start of the pandemic, Class C tenants have been less consistent in delivering rents than their Class A and B counterparts (Figure 1). Low-wage households have been hit the hardest during the pandemic as unprecedented job loss has left many, previously living paycheck-to-paycheck, facing growing financial struggles and an inability to pay their rent. As a result, many cities have enacted rent control and eviction ban measures, a potential headwind for residential property owners that was emerging well before the pandemic and is only expected to continue as the nation sorts through the scarring left from the virus. With the added uncertainty of whether some cities may pursue more permanent and widespread rent regulations and anti-real estate policies, investors may find it harder to achieve the confidence necessary to transact, stunting real estate investment in select urban locales.

Not wholly dissimilar to our take last year, we continue to favor markets with a dynamic employment base and assets that benefit from resilient demand by virtue of lower rental rates compared to luxury Class A counterparts.

Industrial

Coming off an already-strong year in 2019, industrial thrived during the pandemic as consumers were forced to swap out in-person shopping for e-commerce during mandatory shutdowns across the country. In fact, during the peak of the summer lockdown, e-commerce sales were up 76% year-over-year, with many online retailers unable to keep up with consumer demand.

"...during the peak of the summer lockdown, e-commerce sales were up 76% year-over-year, with many online retailers unable to keep up with consumer demand.”

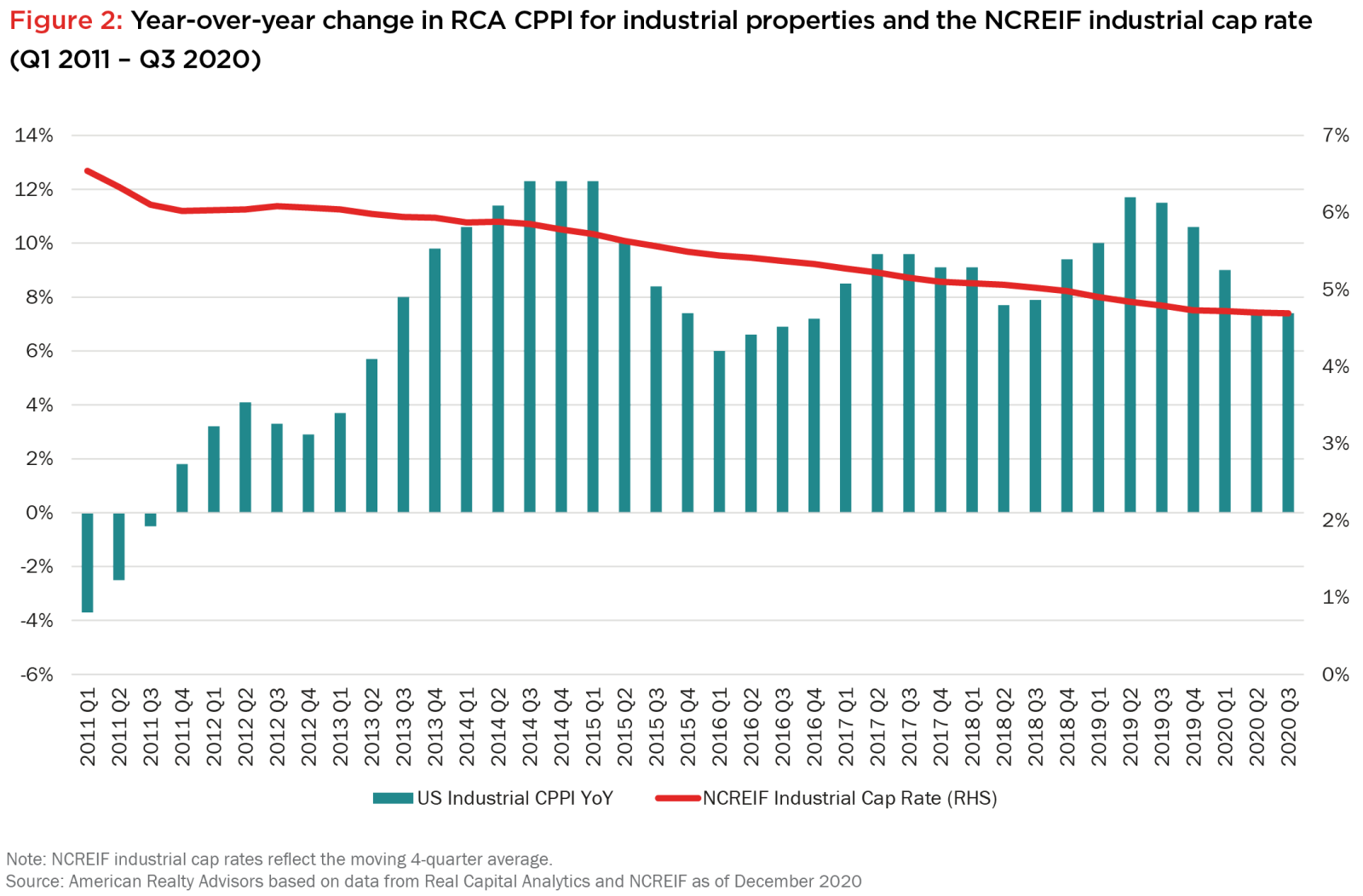

As a result, industrial demand is expected to remain strong as corporations rediscover the importance of onshore stockpiling from disrupted supply chains and inventory shortages caused by global shutdowns. This robust fundamentals backdrop has supported ongoing price growth in the sector – in fact, Real Capital Analytics reports the price index for national industrial properties increased a robust 7.4% year over year in Q2 and Q3, driving cap rates to all-time lows in the sector (Figure 2). Going forward, pricing will continue to be a headwind for traditional industrial assets, pushing investors to more specialized subsectors, such as cold storage, in order to benefit from greater yield, albeit with greater execution risk.

We expect industrial assets to maintain strong performance, bolstered by continued rental rate growth, with most major markets achieving in excess of 10% cumulative growth over the next 3 years. We expect rents to grow fastest in Portland, Northern New Jersey, and the Inland Empire. To capitalize on strong fundamentals, we are focused on ensuring the product we deliver is well-suited to market needs and selling stabilized assets into a deep capital appetite.

Office

As workers acclimated to working from home en masse throughout the pandemic, companies across the nation opted to put unused office space onto the sublease market, rather than continue to pay for underutilized space. Totaling nearly 100 million square feet nationally as of Q3 2020, the sublease market could take close to 2.5 years to return to normal levels based on recovery patterns from the last recession – and this assumes that the appetite for space on the other side of the pandemic mirrors that of the GFC, which may be fundamentally altered as a result of the WFH movement. The substantial amount of sublease space in urban markets will create downward pressure on direct space rents over the next 12-18 months; however, portfolios with greater weighted-average lease terms for office will fare better as they are less exposed to sublease competition.

Although we believe workers will return to the office in some form, a lasting shift towards work-from-home flexibility may ignite a redistribution of office workers around the country. Sun Belt metros and other lower-cost secondary markets appear poised to benefit from more permanent relocation of workers. In particular, markets in Texas, Arizona and Florida are forecasted by Moody’s to experience between 2 - 4% office-using employment growth per annum through 2024, compared with select urban locales’ much more muted forecasts.

Our continued focus is on maintaining long-term leases throughout our office portfolio, as well as retaining best in-class properties that help facilitate top-tier tenants in their talent recruitment and retention agendas.

Retail

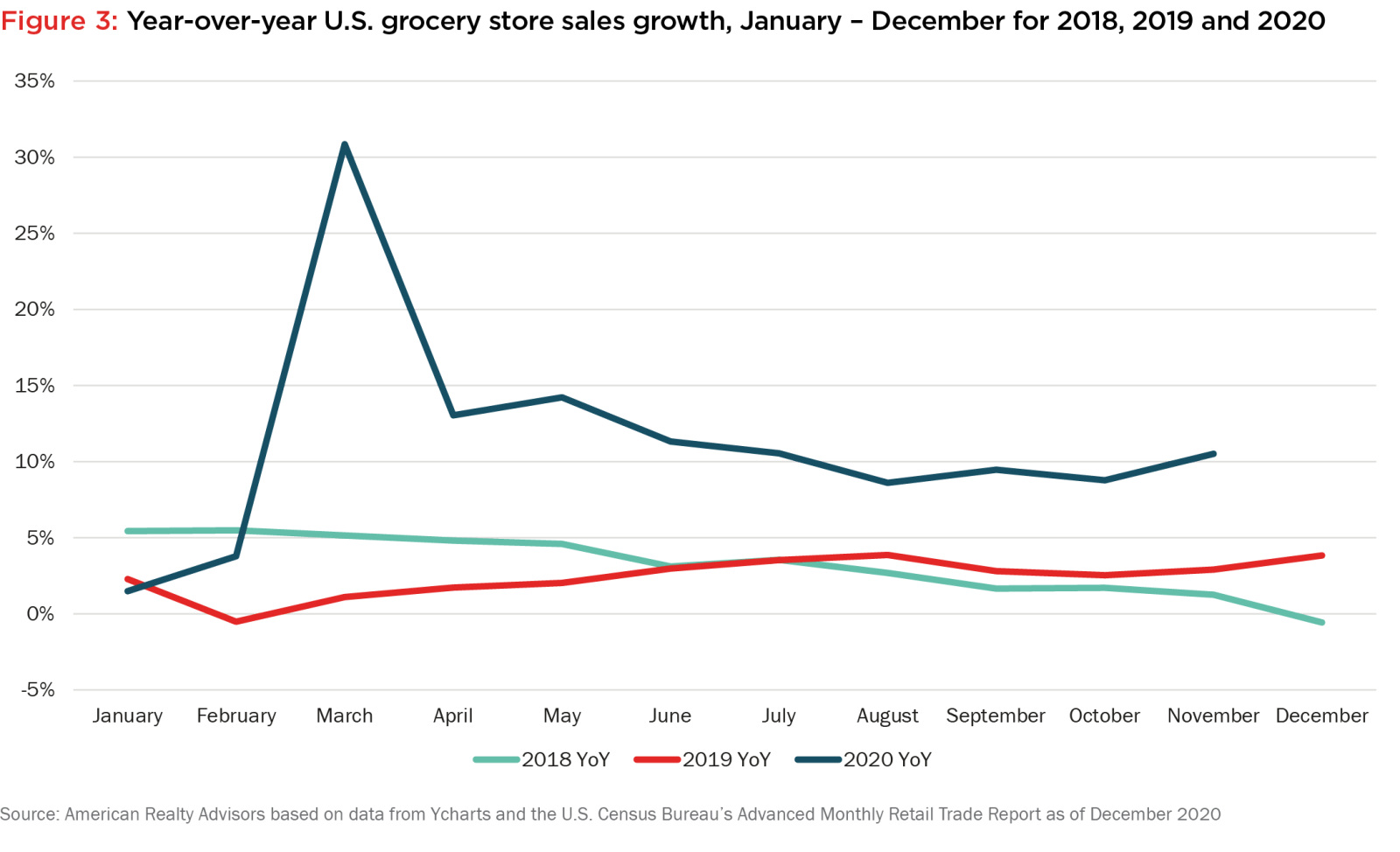

Even prior to the pandemic, the retail sector had been undergoing a painful transformation in the wake of ever-increasing e-commerce penetration. With COVID-19 necessitating an even greater reliance on online fulfillment for everyday needs, the steady stream of store closures continued. By our calculations, more than 12,000 store closures were announced in 2020 (more than 159 million sq-ft), and if the GFC stands as reference, we have not seen the end of this recent wave of retail casualties, as many are expected to be announced in Q1 2021 as the holiday season appears to have been unable to save failing store brands. That being said, we have also seen strong growth in necessity retail, with grocery being the standout pre-pandemic and the pace of sales growth accelerating during the height of the shutdowns and remaining elevated in the months following. Since May, monthly year-over-year grocery sales have averaged a robust 10.5%, far surpassing the 2.9% YoY average during the same period in 2019 (Figure 3). As a result, it comes as no surprise that neighborhood and community centers featuring necessity anchors have fared better than discretionary-oriented shopping centers and malls. Moreover, many discount and necessity retailers have announced expansion plans in the face of the pandemic, further intensifying the bifurcation between the winners and losers in the industry.

Given our singular focus on necessity-oriented offerings, we are well positioned in our retail holdings. Moving forward, we expect the retail sector more broadly to offer the deepest pool of distressed assets for potential value-add and opportunistic strategies.

Specialty Sectors

With two of the four main core sectors facing transformative disruption, investors have begun searching for yield and diversification in more specialized asset classes, such as life science, cold storage, data centers, and single-family rentals. As industrial and multi-family assets are deemed the clear front runners of the four main core sectors, it comes as no surprise that the strongest investor demand in specialty sectors is coming via cold storage and single-family rentals as ways to play off the similar secular drivers. Both sub-sectors have experienced strong fundamental development this year due to increased e-grocery shopping and young professional households forgoing cramped apartment space for larger single-family rental units. As a result, we have witnessed insulated rent growth in both sub-sectors. In fact, according to the John Burns US Single-Family Rent Index, YoY rent growth in single-family rentals was 3.8% in September 2020, compared to institutional quality multi-family that saw a 3.2% annualized decline in rents over the same time period.

Due to the operational complexity of these assets, institutional capital is only beginning to increase its allocation to these sectors and, as a result, strong appreciation is likely to occur over the next few years as investor appetite and comfort grows. We are most bullish on those specialty sectors that cater to aging Millennials (single-family rentals), shifting consumer preferences (cold storage) and technological advancements (data centers).

Summary

The residual damage of the worst pandemic in a century still remains to be seen. How effectively stimulus measures address specific economic issues will largely firm up the timeline and pace of the recovery through 2021. As such, while 2021 is widely expected to be an improvement from 2020, the focus has now shifted to how quickly the economy will recover.

With the first half of the year to be marked by mass distribution of COVID-19 vaccines and a new administration at the helm focused on boosting economic growth, business and consumer confidence is likely to trend upward. In our view, the next phase of this new economic cycle will be underpinned by renewed optimism, a materializing of pent-up demand, and fresh policies.

While there is greater clarity today than where we stood even six months ago, economic uncertainty is likely to be a hallmark of the near-term investment backdrop. For real estate, this likely means bigger differences between market and sector winners and losers with less room for error, with the former marked by strong structural drivers (like demography and technology) and the latter denoted by disruption-driven obsolescence.

In other words – mind the megatrends.

"With the first half of the year to be marked by mass distribution of COVID-19 vaccines and a new administration at the helm focused on boosting economic growth, business and consumer confidence is likely to trend upward.”