Mid-Quarter Economic Pulse: Q2 2025

As we get closer to closing out the second quarter, ARA Research takes a look at the various factors weighing on the economy and explores whether they stand to impact the real estate recovery.

With roughly a month to go until the end of the second quarter, uncertainty, and the economic pause that tends to come with it, continues. Headline figures on unemployment and inflation have remained benign, but challenges to corporate profits are prompting layoffs that saw the largest number of Americans collecting unemployment checks in three-and-a-half years as of mid-May.

The April PCE reading (the Fed’s preferred measure of inflation) reflected a rapid cooling of inflation that might have signaled an appropriate point for the Fed to resume cutting rates, but the uncertain impact of tariffs has delayed any action.

The ongoing threat of tariff escalations and the potential for growing deficits from the proposed budget bill has clouded the outlook for mid-term inflation expectations, and with it, the forward path for interest rates. The Fed has kept rates unchanged at a 4.25 – 4.50% target range since the last easing in December of 2024, and recent comments from FOMC members reflect a growing concern over the tradeoffs between combating inflation and supporting economic growth.

We believe the Fed will be prompted to cut once or twice before the end of the year, based on a view that the new administration will find a path to impose at least some degree of tariffs, and the growth side of the equation will become a more pressing issue than the upside to inflation. Even still, a backdrop with higher tariffs is likely to reinforce a cycle with structurally higher interest rates, which may require different investment tactics than those that dominated the post-GFC pre-pandemic period.

Implications for Real Estate

Despite the volatility of the past few months, the impact on real estate has been muted. Optimism fueled an uptick in transaction volumes in the first quarter but took a pause post-Liberation Day (April 2). Financial and debt markets started to show signs of re-engagement shortly thereafter when the White House announced its extended negotiation periods on reciprocal tariffs.[1]

Any renewed negative news about the economy and tariffs could take time to materialize in pricing and deal flow. Deal volume in both March and April were on par with that of the same period in 2023, and the pace of price declines continued to moderate.[2]

We anticipate that full-year 2025 transaction volumes should mirror those of 2024, as buyers approach transactions more cautiously. Clarity in tariff policy will be welcomed by both businesses and consumers. A softer macroeconomic outlook could delay recovery but also offer more time to find opportunities where alpha is driven by improvements to operations rather than from cap rate compression.

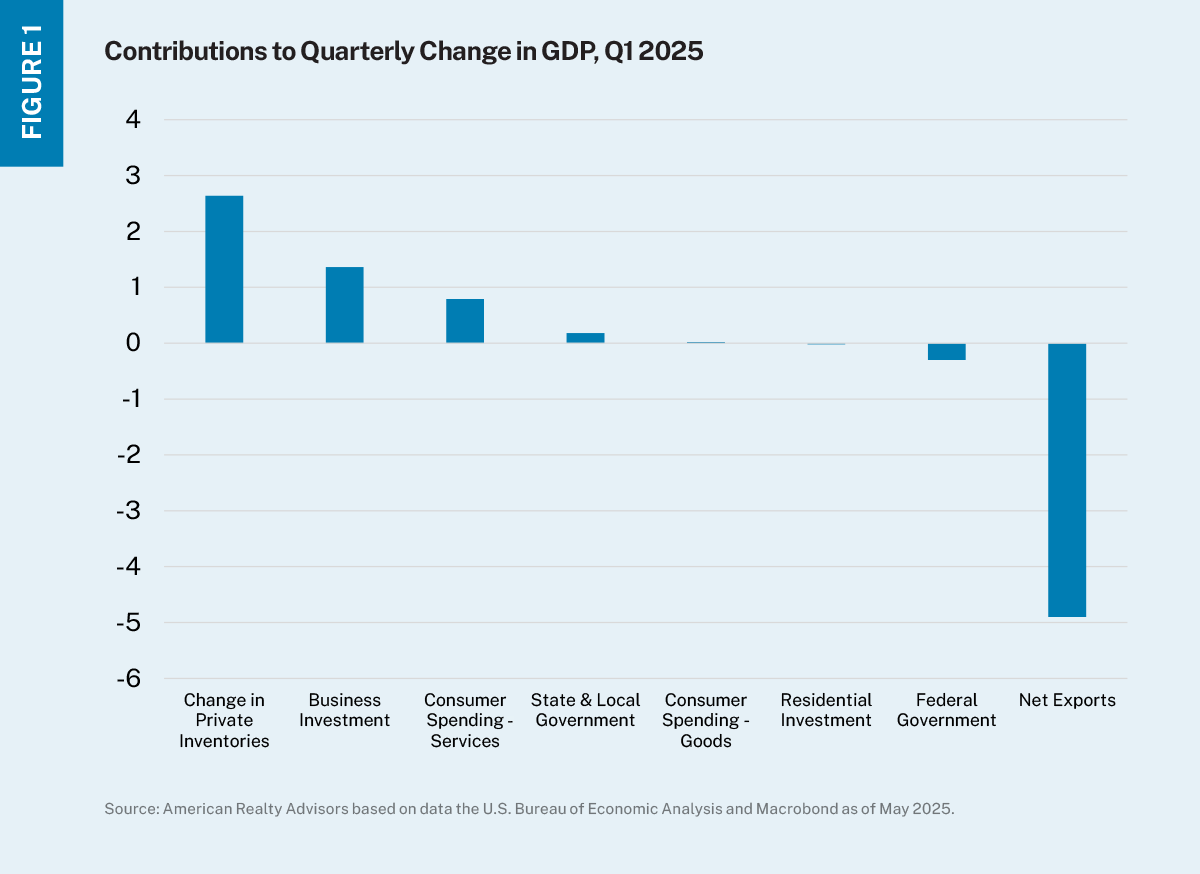

A Deeper Look at GDP

First quarter GDP shrunk at an annualized rate of 0.2% as of the second estimate release. Even though the revisions between the advance estimate and the second were better than expected, the contraction (the first since early 2022) suggests a downshift and reversal from 2024’s steady growth. The decrease was driven in part by a surge in imports as companies rushed to bring in goods ahead of anticipated tariffs, resulting in the largest drag from net exports on record (Figure 1).

This by itself wouldn’t be so worrying, but consumer demand (measured by spending) has also pulled back. Relative to the fourth quarter, consumer spending growth slowed significantly in Q1, from 4% to 1.2%. Whether this is a result of tariff-related anxiety or something stickier may come down to how the labor market plays out going forward. If labor holds up, the consumer might feel confident enough to resume more meaningful spending.

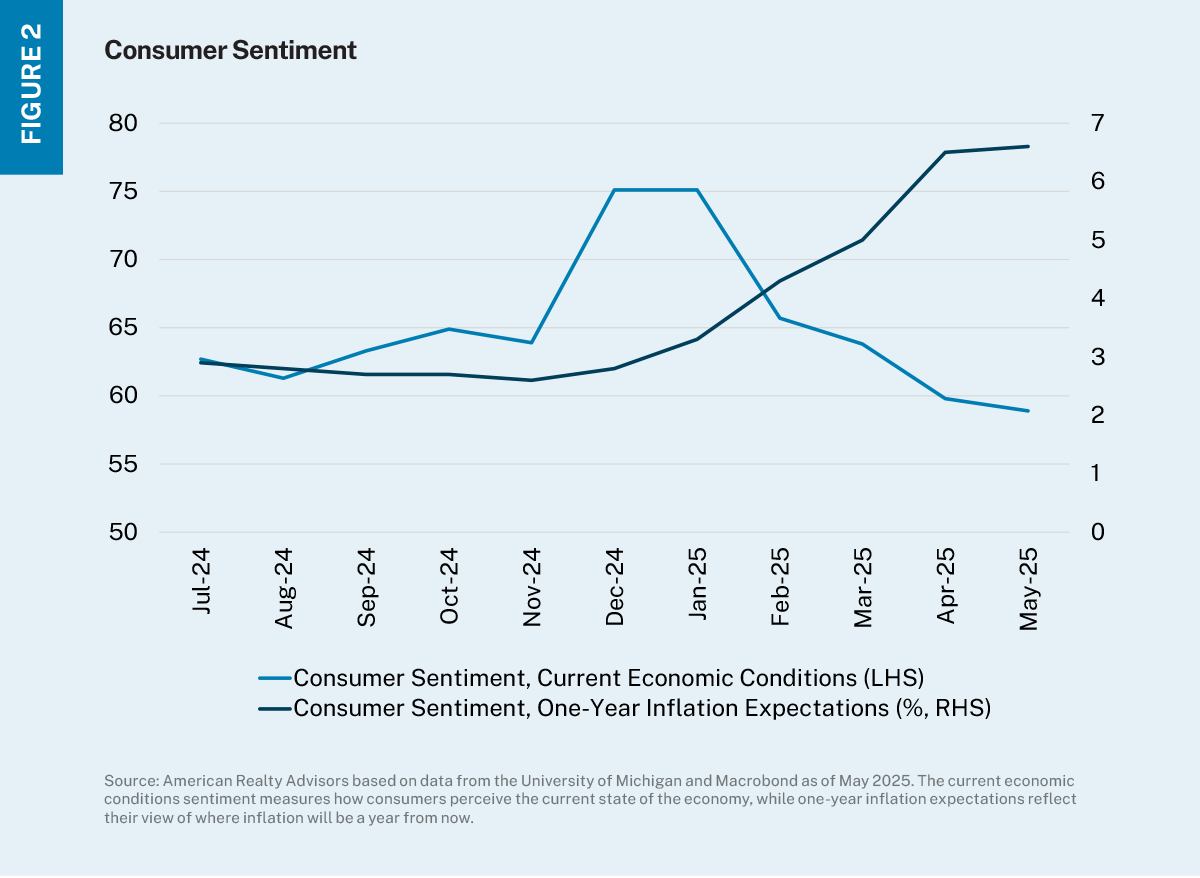

Consumer sentiment also weakened in the wake of tariff talks. Consumers’ view of current economic conditions dropped to 59.8 in April and declined further in May despite the temporary trade truce with China. The decline corresponds with a resumption of upward expectations for inflation and, while consumers are usually better at evaluating current conditions than they are at forecasting, sentiment readings suggest that consumers are still wary about inflation and less confident about their prospects (Exhibit 2).

The outlook for the economy is far from vibrant, and the risk is that businesses and consumers grow more pessimistic and pull back further. The silver lining, however, is that these downdrafts are policy driven, and if policy changes, conditions can turn on a dime.

The positive takeaway is that real estate has already undergone a period of repricing and fundamental adjustment, and this should allow the asset class to weather a slower-growth period. At the same time, a more gradual pace of improvement should also extend the opportunistic buying window, offering investors what we believe is a once-in-a-generation entry point at attractive valuations.

Tracking Progress in the New Real Estate Cycle