Research Insights, September 26, 2019

Prospering Late Cycle While Preparing for Longer Term Success

Record equity market valuations followed by bouts of severe volatility, plummeting fixed income yields, slowing economic growth, and highly uncertain trade policies. Welcome to investing in 2019!

- What role can real estate play in this type of environment?

- What are the key questions to consider when investing in real estate in this type of environment?

- How can investors both prosper in this late cycle environment and prepare for long-term success?

Current State: Mixed Picture

Setting New Records

- Longest economic expansion in U.S. history

- Historically low unemployment rate

- Record stock market highs

- Historically low cost of capital

- Nine consecutive years of job growth

Recording Slowing Economic Growth

- Growth in gross domestic product slowed dramatically in the second quarter of 2019 declining from 3.1% in the first quarter to barely more than 2%.

- We are most concerned about the role of slowing business investment in the second quarter – not a reassuring stat.

- Employment growth has also slowed materially, - from an average of 223,000 monthly employment growth in 2018 to 156,000 in the most recent three months.

- Business sentiment continues to sour with employers increasingly on edge in response to erratic trade policy signals and slowing global growth.

- Europe and the Asia-Pacific regions are both struggling to stem growth pullbacks and deflationary concerns.

- Consumer confidence is showing signs of strain - this will deteriorate quickly if hiring continues to meaningfully decelerate to the point of causing an increase, even if moderate in unemployment.

Equity Market Volatility

Something had to give in equity markets as record valuations and meaningful economic slowing are not compatible longer term. One of the two had to adjust, and, as is usually the case, it was equities. After having increased by more than 20% from the beginning of the year, equity markets declined more than 5% in less than five days, more than 3% in one day, and subsequently rebounded despite lackluster earnings.

Declining Fixed Income Yields

- As expected, fixed income markets adjusted abruptly and the yield curve inverted at the short-to-middle, historically a signal of expected economic softening.

- 10-year Treasury rates have fallen by half from a peak of 3.25% last November to less than 1.5% at one point -- a seismic decline driven by a flight to safety.

- AAA fixed income yields followed a similar path declining from 3.83% in November of 2018 to 2.38%.

The Role of Private Real Estate in a Late Cycle Environment

Private real estate continues to buoy investor portfolios against the economic headwinds and financial market volatility buffeting investors.

Low Correlation to Equities

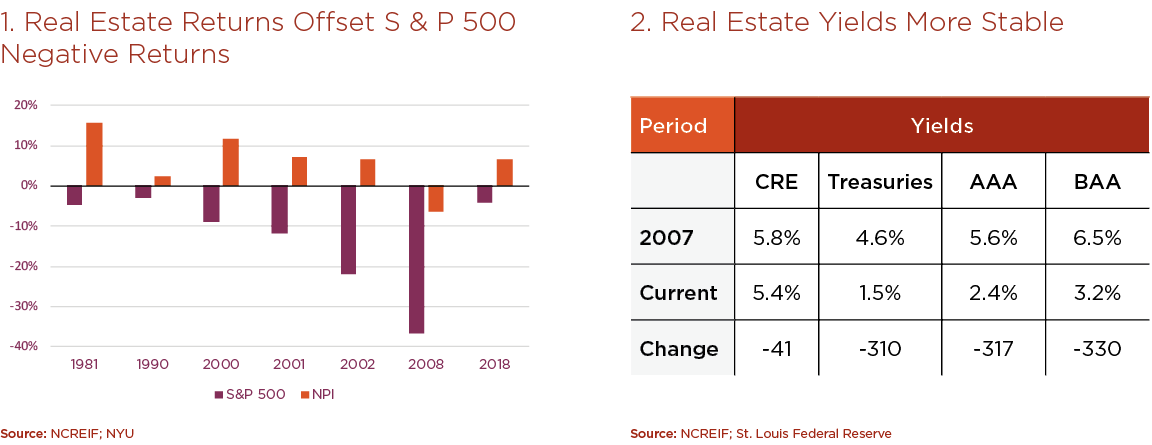

- Private real estate is largely uncorrelated with the returns on public securities and can act as a risk mitigator in a multi-asset portfolio. Since 1978, real estate returns have been positive in every year the S & P 500 experienced negative returns except one. (see chart below)

- Since 1978, real estate returns have been 7% or greater in two-thirds of the years during which S&P 500 returns were less than 7%. That’s diversification.

Heightened Income Yields and Yield Premiums

- The premium in real estate spreads is even wider than before the GFC. In 2007, private real estate yields were 120 basis points greater than 10-year Treasury yields and 20 basis points greater than AAA fixed income yields. (see table below)

- Today, private real estate yields are 390 basis points greater than 10-year Treasury yields and 300 basis points greater than AAA fixed income yields.

Income Growth Potential

- Fixed income assets have little to recommend them beyond minimal yields, the potential for negative returns going forward and no protection from inflation.

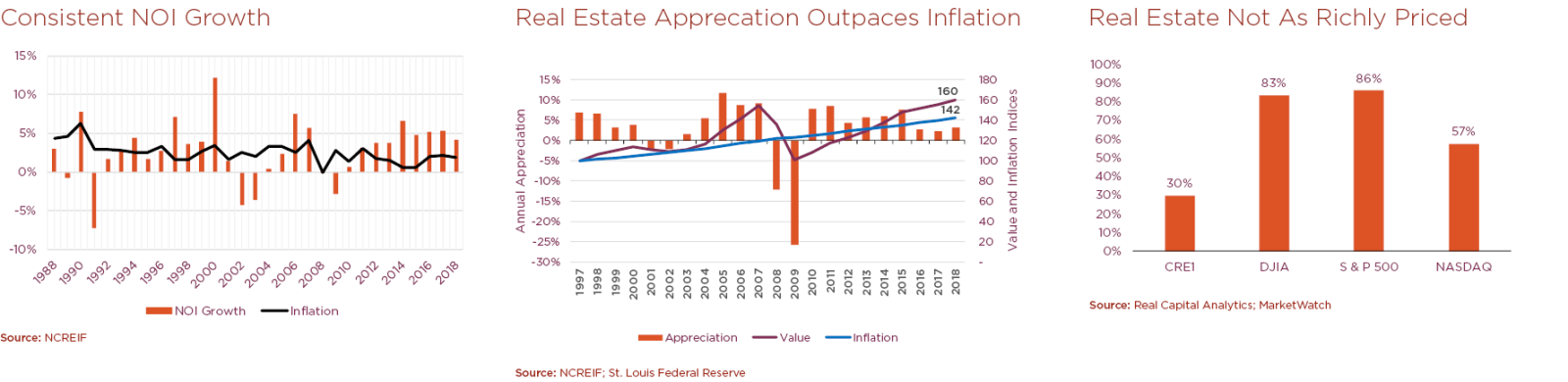

- Real estate, on the other hand has experienced positive income growth in 26 of the last 31 years with the median growth rate being 3% versus 2.75% for inflation. (see top chart)

Long-Term Appreciation Capacity

- Real estate values have increased in 18 of the last 22 years and values have increased 60% since 1997 while inflation increased 42% during the same period.

Relative Pricing Value

- Investors are rightly focused on asset valuations given the fully priced environment. What may be surprising is that private real estate valuations are much less richly priced than equity valuations relative to the prior cycle’s highs.

- While real estate valuations are 30% above the prior cycle’s peak valuation, equity market valuations remain much more elevated even after the most recent downdraft in equity valuations.

Prospering Late Cycle While Preparing for Next Cycle Success

Investors may be tempted in the current environment to just put their money under the mattress. However, in real estate, there are attractive opportunities available that provide income normally derived from fixed income as well as market appreciation one expects from equities. We believe there are four key considerations or questions to consider in making investment decisions today:

- Is now the time to be overweighting or underweighting risk?

- What sector should one over/underweight?

- What markets offer the best opportunities?

- What asset attributes can provide the most attractive risk-adjusted returns?

Is now the time to be overweighting or under-weighting risk?

This depends on the economic environment and your outlook as well as pricing. The economy is slowing and is expected to slow further while many assets are fully priced. We believe that now is the time to underweight risk given the asymmetry between downside risk and limited upside appreciation potential.

What sector should one over/underweight?

The second consideration is which property sectors to over and underweight? Here we look to current property fundamental trends and the point in the economic cycle.

- Industrial is currently the star performer with the most favorable property fundamentals and is desirable at this point of an economic cycle due to relatively low costs related to replacing a tenant should the needs arise during economic weakness.

- Multi-Family fundamentals are strengthening with solid demand driven by low single-family housing affordability, plateauing supply, and the continuing stability of occupancy rates. While rents may fluctuate, occupancy is relatively stable.

- While office property fundamentals are stable today, they are the most susceptible to a slowdown in employment growth. Add in significantly higher tenant improvement costs and office becomes a clear underweight late cycle. In this sector, the focus should be on newer assets having strong credit tenants with longer-term leases.

- Retail remains a story of “haves” and “have nots” with substantial variation in performance across assets, where well-placed necessity-based retail keyed to their trade area demographic should outperform regional malls filled with undifferentiated, full-price retailers. While significant repricing of retail assets may create select desirable contrarian opportunities, the broad impact of ecommerce headwinds places regional malls squarely in the underweight category.

What markets offer the best opportunities?

Industry Trends

Technology will continue to disrupt entire industries creating economic winners and losers. As we wrote in the research piece, “Tech Disruption and Commercial Real Estate”, the key is to invest where technology is creating not constraining jobs. We recommend investing in markets that are expected to thrive over the long-term from disrupting technologies while under-weighting markets anchored in jobs most exposed to disruption.

These markets may be more volatile in the near-term reflecting the volatility of the tech sector and this requires heighted discipline in targeting assets with longer-term leases to tenants with greater financial wherewithal to moderate any impact of tech market volatility.

Population Trends

Population growth continues to shift from the Northeast and Midwest to the Southwest and Southeast. While the pace should oscillate with the economic cycles accelerating during expansions and decelerating during recessions, we expect the Southwest and Southeast to be longer-term population winners while the Northeast and Midwest lag.

The challenge with investing in these markets is a relatively lax regulatory environment and ample land availability that creates greater supply pressures over the long-term and that can lead to rent growth lower than would be indicated by population growth alone. Discipline in selection through correctly underwriting rent growth assumptions that reflect long-term trends and not recent outsized gains will be critical.

What asset attributes can provide the most attractive risk adjusted returns?

Lease Duration

As noted above, lease duration is one of the most impactful factors in determining portfolio risk. At this point in the cycle when the economy is materially slowing, assets with longer-term leases, especially those with contractual increases, can yield better income predictability.

Select markets and submarkets offer near-term opportunities to capitalize on exceptionally favorable property fundamentals through shorter-term leases at below market rents.

Tenant Credit

Long-term leases only have value if the tenants signing the leases can fulfill their lease obligations. This makes tenant credit critical. Start-ups, newer companies in expansion mode, private equity owned companies with significant debt, smaller companies with more limited access to financing, and tenants in industries facing significant growth and margin headwinds face greater challenges in fulfilling lease obligations and are more susceptible to the effects of a slowing or contracting economy.

Asset Quality

Asset quality also impacts a portfolio’s risk profile. The search for additional yield may lead some to search among lesser quality properties that aren’t value-add plays where the investor plans to make significant upgrades but pure yield plays. While this may work in certain markets in the near term, when tenant demand contracts it is the lower quality assets that will feel the pain.

In the battle for tenants, higher quality buildings can “buy” occupancy and attract tenants from competing buildings through rent concessions. While higher quality buildings can lower rents, lesser quality buildings cannot. In addition, the pricing spread between higher and lower quality assets is currently compressed. Combined, these indicate an overweight to higher quality assets.

There are also opportunities to create or restore existing assets to high quality status with longer-term leases and strong credit tenants.

Strategy Implications for Commercial Real Estate

The first half of 2019 has confirmed our beginning of the year outlook for “growing but slowing” job creation and economic expansion. As a result, our portfolios are well positioned to capitalize on current opportunities as well as for today’s uncertain economic environment. By focusing on acquiring or creating high-quality, well-leased assets, real estate can provide both a stable source of income and the possibility of increasing cash flows.