Research Insights, March 01, 2019

Look Back, Look Forward - Commercial Real Estate Outlook

- The year 2018 showed a stark contrast between the volatility of public securities and the stability of commercial real estate, with the S&P 500 down 4.4% while core real estate returned positive 6.7%. With unemployment at historic lows, the economy should grow but at a slower pace, with year over year GDP growth projected to be 2.2 % in 2019. In addition, the yield curve continues to flatten with the Fed having pushed up short term rates while the market is trending longer rates lower.

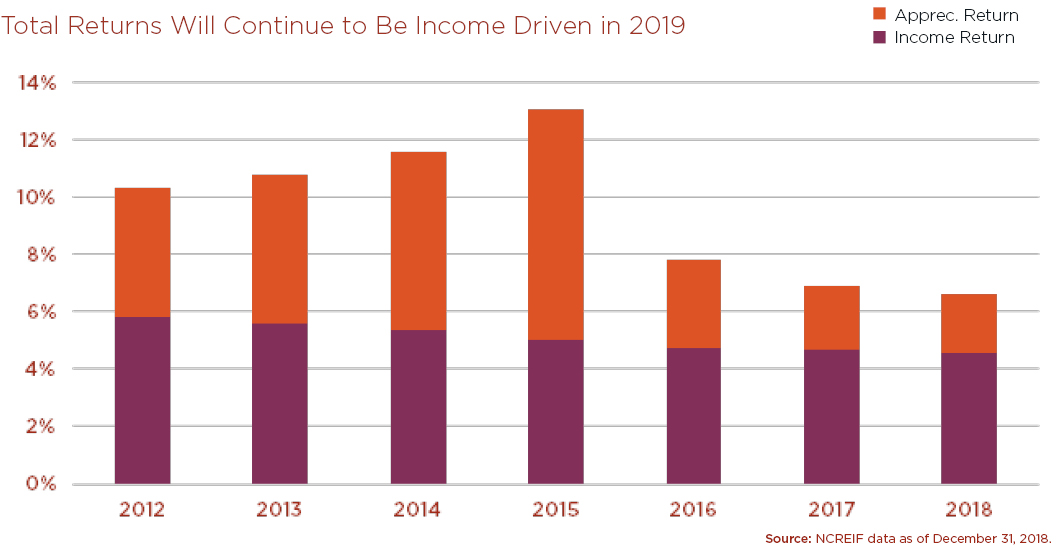

- In this environment, commercial real estate investors are now turning their return focus from relying on cap rate driven appreciation to seeking stable and predictable income. We believe industrial and multi-family will continue to present the most attractive return potential for 2019 with office and retail requiring highly selective market strategies. Our House View projects that real estate in 2019 will once again provide attractive risk-adjusted returns especially from those assets with stable income, high quality tenancy, and longer leases.

Peaking Into 2019

Despite the Federal Reserve telegraphing and then following through on raising short-term rates, investors only awakened late in 2018 to the reality of the slower pace of growth this implies for the economy. Combined with tense U.S.-China trade relations and potential negative growth implications as well as the slowing of both domestic and global growth, the equity and bond markets are likely to whipsaw at every Fed utterance and new economic datapoint. In this environment, ARA recommends investors take a longer-term view of portfolio composition focusing on diversification and controlling risk.

It is our view that the end of 2018 stock market volatility and the daily news feed of political and economic tensions are masking the fact that the economy is still growing, albeit more slowly. Corporate profits remain healthy, business and consumer balance sheets are manageable, and the tailwinds from fiscal stimulus, combined with a more moderate Fed monetary policy suggest a steady-as-you-go growth pattern for 2019, although at a slower pace than last year. We believe that 2019 U.S. real GDP growth will be 2.0-2.5% -- a positive environment for commercial real estate to perform.

Anticipating this environment, we have been shifting our investment position to further favor acquiring or creating assets with in-place income, reduced dependence on appreciation, focusing our investment activity in the most dynamic and resilient markets as well as assets with durable and growing income streams from stronger credit tenants and extended lease durations.

Investor Sentiment and Economic Growth

Looking Back: Is That All There Is?

Investor sentiment was highly volatile in 2018, swinging from early exuberance to increasing pessimism later in the year. Economic growth was spurred by fiscal stimulus with second quarter GDP growth roaring to greater than 4%. Seeing these positive economic signs, the Fed maintained its steady pattern of raising short-term rates and growth began to moderate. While this may be surprising to some, we noted in our 3Q 2018 economic commentary, “Riding the Economic Wave…for Now”, the primary question was never really whether fiscal stimulus would lead to economic growth, but rather for how long? In the fourth quarter, this became evident as global economic slowing and political uncertainty wiped out YTD stock market gains and the overall sentiment shifted to heightened uncertainty of what lay ahead.

Although underlying economic growth remained positive even as some sectors slowed, what is surprising is the speed with which investor and business sentiment shifted from exuberance to caution. According to a Duke University’s CFO Global Business Outlook, nearly 50% of chief financial officers now anticipate a recession by the end of 2019. ARA’s outlook is that any significant slowdown is likely to be a year or more off.

We believe that in 2019 commercial real estate should remain attractive to investors especially at this stage of the market cycle. Assets in prime locations will continue to be in demand allowing owners to push rents and increase net operating income.

Multi-Family

Multi-family vacancy continues to decline and, at the market level, 20 of the 25 markets we track saw a year-over-year reduction in vacancies in 2018. We will watch this trend closely as some fundamentals remain in recovery stage with most of these markets still experiencing a vacancy rate above the long-term average.

In 2019, we expect elevated mortgage rates and continuing high single-family home prices nationally to continue to make multi-family attractive. Careful selection of assets and submarkets will continue to be a key differentiating factor in performance.

Near term, we are underweighting markets with elevated near-term supply levels and slower rates of rent increases, favoring instead those markets where specific local fundamentals continue to be strong. In certain markets where there is currently a premium of acquisition prices over replacement cost, we are targeting selected development investment that has the potential to enhance long-term returns and to be a strategic means to reduce basis risk.

Longer-term, we favor markets with superior historical return performance, low housing affordability, and elevated education levels.

Industrial

As we expected, industrial outperformed all other sectors in 2018 and vacancy remained historically low with rent growth above 6% year over year. Net absorption did moderate, but this was likely due to capacity constraints within the larger logistics supply chain including significant capacity issues in the trucking industry.

In 2019, we anticipate that growing e-commerce sales, healthy consumer spending, and a near-term boost in disposable income due to the tax cuts will continue to support both national and local/regional distribution and warehouse demand. While there are risks to the demand outlook due to trade policy uncertainty, we believe the strong domestic demand will continue to keep industrial demand strong.

Office

The office sector most benefitted from the uptick in employment growth in 2018 as net absorption increased significantly reaching more than 55 million square feet, a 70% increase over the year prior. In primary markets, 14 of 24 saw a year-over-year reduction in vacancy rate while half of these already had a vacancy rate below their long-term average.

Based on our outlook for slowing employment growth, we expect office net absorption and supply to moderate in 2019. We will continue to acquire or create assets with longer-term leases to stronger credit tenants in markets with elevated levels of education and technology employment as well as low-cost markets experiencing exceptional population and employment growth.

Retail

Wage growth is strengthening and with tax driven increases in disposable income, we expect a meaningful increase in retail spending in 2019. There is an increasing performance gap between old-line retailers selling undifferentiated goods at full price and those adaptive retailers thriving by focusing on either the upper income consumer or selling branded goods at discounted prices to value-conscious consumers. In 2019, this should continue along with ecommerce headwinds pressuring traditional brick and mortar sales.

ARA’s focus is on assets that have the four pillars of successful retail centers: a market with growing employment and/or income levels; elevated trade area income; a strategic location within the subject trade area; and a superior tenant mix.

Summary

Looking to 2019, we are cautiously optimistic about the opportunities in commercial real estate. Although values in many markets are likely near a peak, and moving into an extended period of plateauing, we are training our focus on where asset selection is likely to triumph over market selection. The exception to this would be retail, which should continue to experience pricing headwinds and where locations in successful trade areas will be a significant differentiator. The primary risks we see to real estate capital flows and pricing in 2019, absent a recession, are the continued deterioration of investor sentiment and rising corporate bond yields. BBB bond yields have risen more than 110 basis points over the past year and AAA bond yields have risen more than 70 basis points. Although real estate capital flows are currently robust, ARA is focused on any increase risk from a significant negative shift in investor sentiment and the potential for a broad flight to safety reducing capital flows.

Cervantes said, “Forewarned, forearmed: to be prepared is half the victory.” While the end of 2018 may have left some feeling unnerved and unprepared, we believe our portfolios are well positioned – ARA continues to acquire or create assets that strengthen the predictability of income streams through longer lease durations, stronger tenant credit, best in class buildings, and in place income, all in proven markets. While no one can know the future, our conviction in our strategy positions us conservatively at this stage of the cycle while still allowing us to capitalize on opportunities resulting from continued economic growth.